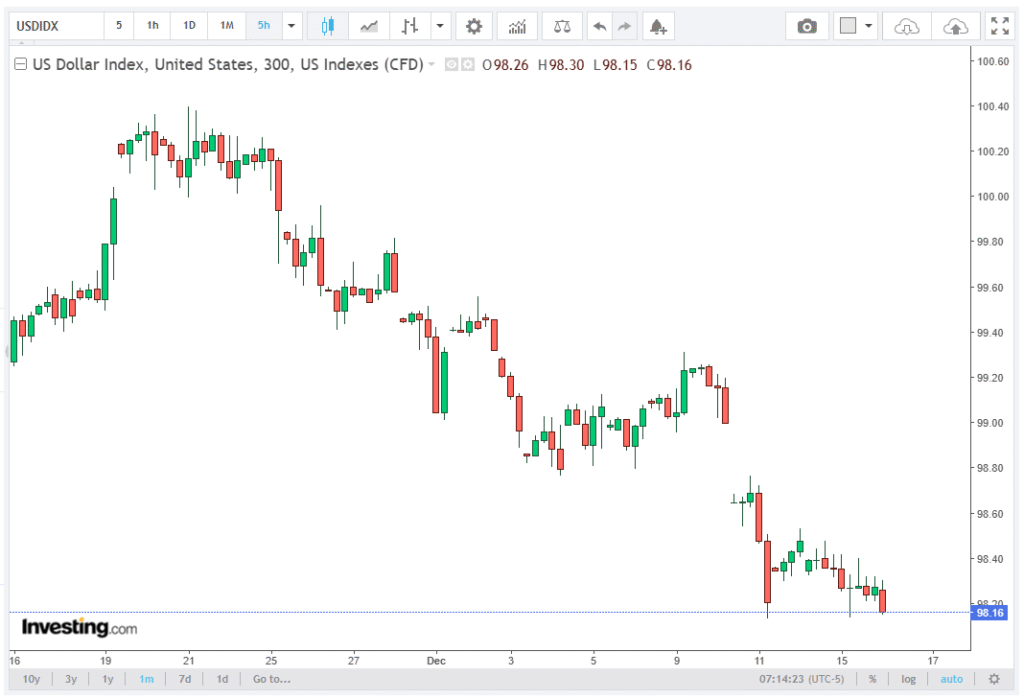

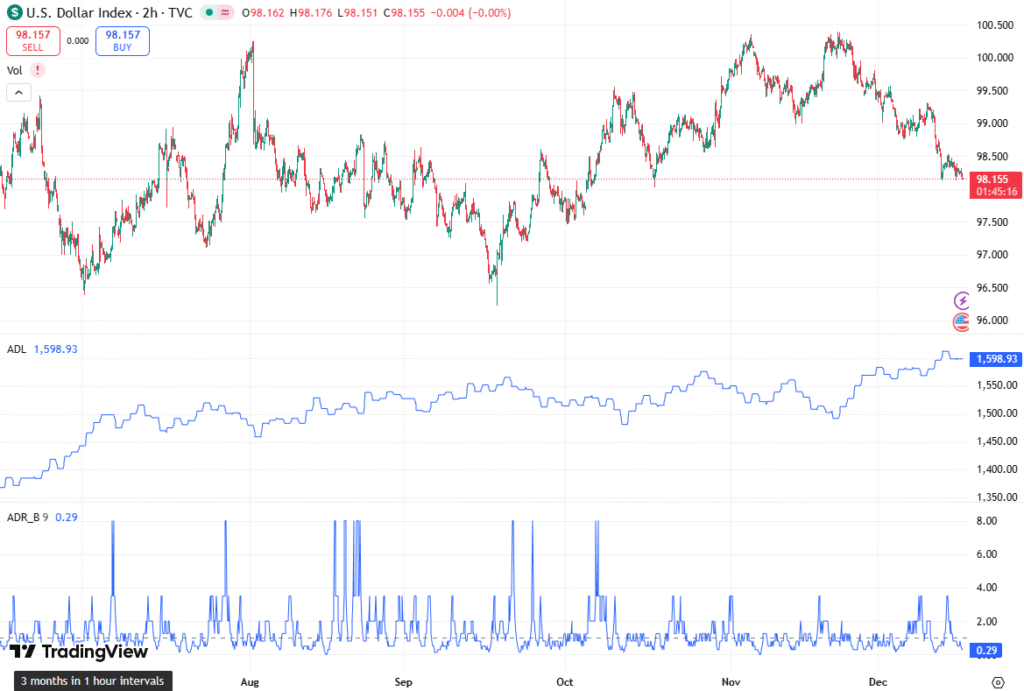

The US Dollar Index (DXY), which measures the performance of the US Dollar (USD) against a basket of six major world currencies, weakened during Tuesday’s early European trading session, trading near 98.25. This decline comes as market participants adopt a cautious stance ahead of key US economic data releases, including the delayed November US jobs report. This article from Orbisolyx offers readers a clear and in-depth explanation of the subject.

Traders have been adjusting positions in the foreign exchange (FX) market, reflecting expectations for volatility around Nonfarm Payrolls (NFP) data and the potential implications for US monetary policy. The softer tone in the DXY indicates a temporary loss of momentum in the Greenback, as investors weigh the latest signals from the Federal Reserve (Fed) and broader economic trends.

Spotlight on US Employment Data

All eyes are on the US Nonfarm Payrolls (NFP) report, which will cover both October and November. The NFP report is a critical gauge of US labor market conditions and can heavily influence expectations for interest rate decisions.

If the employment data signals a slowdown in job growth, it could reinforce market expectations of potential Fed rate cuts later in 2026. This scenario typically puts downward pressure on the USD relative to major counterparts such as the euro (EUR), Japanese yen (JPY), and British pound (GBP). Conversely, stronger-than-expected NFP numbers could provide short-term support to the US Dollar Index, potentially prompting renewed strength across USD currency pairs.

Market participants will also examine related indicators such as the unemployment rate, average hourly earnings, and labor force participation, which provide a broader context of the US economic health. Any deviations from consensus estimates could trigger sharp moves in the DXY and influence FX market sentiment.

Federal Reserve Policy Outlook

Last week, the Federal Reserve delivered its third quarter-point rate reduction of 2025, lowering the federal funds rate by 25 basis points (bps) to a target range of 3.50% to 3.75%. This decision was interpreted by analysts as a measured approach amid signs of moderating inflation and employment risks.

The CME FedWatch Tool shows that markets see a 76% chance of the Fed maintaining rates in January 2026, pointing to stable expectations for US monetary policy. Traders are keenly observing Fed statements, since hawkish comments could strengthen the DXY, whereas dovish hints might weigh on the US Dollar.

Insights from Fedspeak

New York Fed President John Williams stated on Monday that the monetary policy framework is well-positioned for 2026 after the recent rate cut, amid elevated employment risks and a slightly lower inflation risk. At the same time, Fed Governor Stephen Miran emphasized that current policy is still overly restrictive, indicating that further adjustments could be needed if the economy shows signs of slowing.

Traders will continue to parse Fedspeak for clues on the interest rate trajectory, which directly impacts the US Dollar Index. Historically, comments signaling potential policy tightening tend to boost the USD, while statements highlighting economic caution or potential rate cuts often result in short-term DXY weakness.

Market Implications

The current movement in the US Dollar Index reflects a wait-and-see approach ahead of key employment data. A softer DXY near 98.25 indicates that traders are hedging against possible NFP surprises and adjusting positions based on anticipated US monetary policy.

For FX traders, the period leading up to the NFP release is typically marked by higher volatility, especially in USD crosses like EUR/USD, USD/JPY, and GBP/USD. Additionally, bond markets and Treasury yields may respond to surprises in employment data, which can further influence the Dollar’s performance.

Technical Levels to Watch

From a technical analysis perspective, a sustained break below 98.25 could signal further downside for the DXY, potentially testing support near 98.00. Conversely, a rebound above 98.50 would suggest renewed upward momentum, with resistance likely around 98.75–99.00.

Investors and currency traders should closely monitor economic releases, Fedspeak, and market sentiment, as these factors collectively drive short-term and medium-term movements in the US Dollar Index.

Conclusion

The US Dollar Index remains under pressure in early trading, with key employment data and Fed signals dominating market attention. Traders are carefully balancing expectations of rate stability with potential surprises in Nonfarm Payrolls. Any deviation from market forecasts could result in sharp moves in the DXY, affecting global FX markets, commodity pricing, and cross-border capital flows.

With the US economy at a pivotal juncture, the USD outlook will continue to hinge on the interplay between labor market strength, inflation dynamics, and monetary policy decisions, making the coming week a crucial period for forex traders, economists, and financial analysts alike.