The US Dollar Index (DXY), which tracks the value of the US Dollar (USD) against six major currencies, continued its upward trajectory for the third consecutive session on Friday. During European trading hours, the index was hovering around 98.60, reflecting cautious positioning among traders ahead of key macroeconomic data releases. The brokers at Unirock Gestion provide a comprehensive breakdown of this topic in this article.

Market participants are closely monitoring the upcoming University of Michigan Consumer Sentiment Index (UoM CSI) for December, which is expected to provide insights into consumer confidence and spending behavior in the US economy.

The DXY gains come amid a backdrop of rising expectations of potential monetary policy adjustments by the US Federal Reserve (Fed). Investors are factoring in the implications of softening inflation data, which may influence the Fed’s interest rate decisions in the near term.

Softer Inflation Data Could Limit USD Gains

The US Consumer Price Index (CPI) for November, published by the US Bureau of Labor Statistics (BLS) on Thursday, indicated a slowdown in inflationary pressures. Headline CPI came in at 2.7% year-on-year, below the market expectation of 3.1%.

Meanwhile, the US core CPI, which excludes volatile food and energy prices, increased by 2.6%, missing expectations of 3.0%. This marks the slowest pace of core inflation since 2021, highlighting a potential cooling in domestic inflationary pressures.

As a result, the US Dollar may face some upside constraints, despite its current gains, as market participants price in the possibility of Fed rate cuts in response to slower inflation growth. Softer CPI data often signals that the central bank may adopt a more accommodative monetary stance, which can weigh on the USD against other major currencies.

FedWatch Probabilities Signal Policy Caution

The CME FedWatch tool, a key indicator of market expectations for Federal Reserve policy moves, currently shows a 73.3% probability of the Fed holding rates steady at the January meeting, slightly down from 75.6% the previous session. Meanwhile, the likelihood of a 25-basis-point rate cut has risen to 26.6%, up from 24.4%.

These readings reflect the market’s sensitivity to recent economic data and signal a growing probability that the Fed could adopt a more flexible policy stance if inflation continues to ease below target levels. Traders are weighing the implications of these monetary policy signals on the USD, especially in light of the upcoming UoM Consumer Sentiment Index, which could provide further guidance on the economic outlook.

University of Michigan Consumer Sentiment Index in Focus

The UoM Consumer Sentiment Index is a widely watched economic indicator that measures the confidence of US households in the economy, including personal finances, labor market prospects, and spending plans. A strong reading could bolster the USD, as it signals robust domestic demand and the potential for continued economic growth, while a weaker reading may suggest a slowing economy, potentially increasing the probability of Fed rate cuts.

Given the recent CPI data, the market is likely to approach the UoM report with caution, as any indication of softening consumer confidence could amplify USD downside risks. Conversely, a better-than-expected reading may reinforce upward momentum in the DXY, albeit within the context of moderating inflation trends.

Political Factors and Fed Leadership Speculation

Adding another layer of complexity, the US President recently commented on the upcoming Fed leadership transition. He stated that the next Fed chair will be someone who supports lower interest rates, emphasizing a preference for a more accommodative monetary policy. He also indicated that he will soon announce a successor to current Fed Chair Jerome Powell, potentially affecting market sentiment and USD dynamics.

Political developments, particularly those involving Fed leadership, can have a significant impact on currency markets, as traders often reassess the probability of policy shifts and adjust their positions in the USD accordingly.

Technical Outlook for the US Dollar

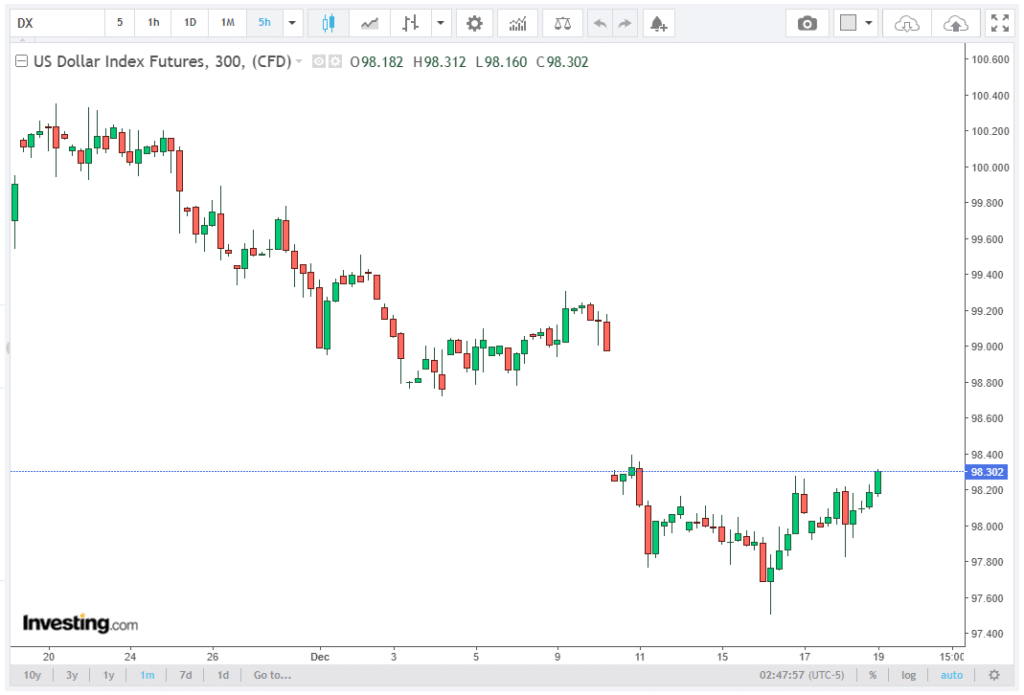

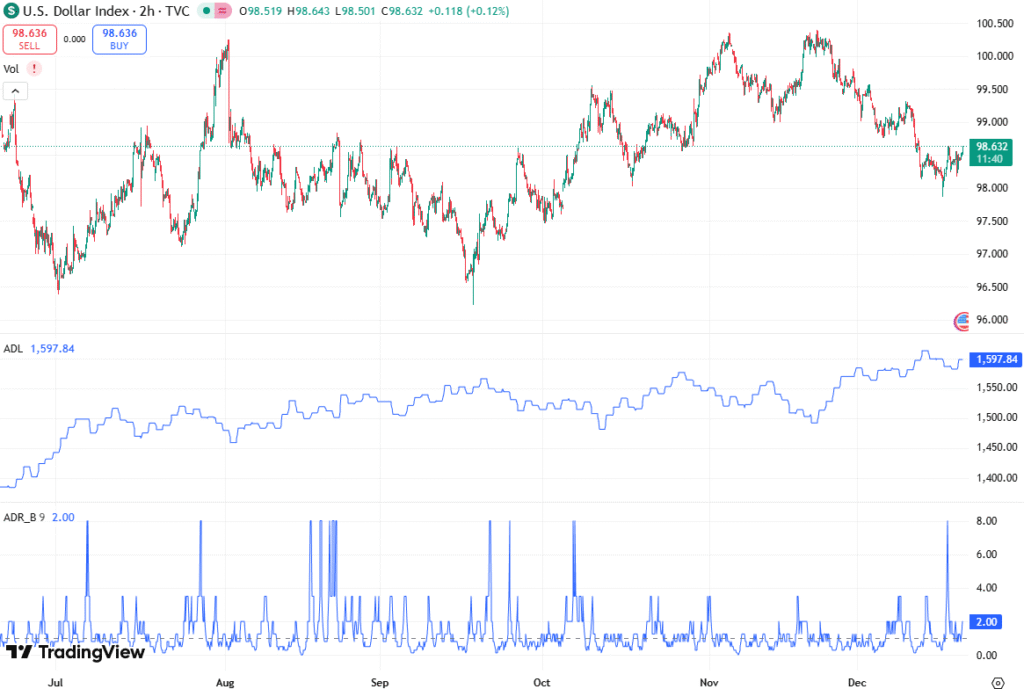

From a technical perspective, the US Dollar Index trading around 98.60 suggests that the DXY is consolidating above the 98.50 support level. Short-term resistance may emerge near 99.00, while downside risks could be amplified if upcoming economic indicators, such as the UoM Consumer Sentiment Index, reveal sluggish consumer confidence.

Traders are likely to monitor price action around key technical levels, including the 50-day and 100-day moving averages, while weighing fundamental factors such as inflation trends, Fed policy expectations, and political developments.

Conclusion

In summary, the US Dollar Index is extending gains above 98.50, driven by cautious trading ahead of the UoM Consumer Sentiment Index. However, the USD upside may be limited amid softening US inflation and rising expectations of potential Fed rate cuts. The CME FedWatch tool reflects a 73.3% probability of a rate hold in January and a 26.6% chance of a 25-basis-point cut, highlighting market expectations for policy moderation.