The US Dollar (USD) slips toward 99.10 on the DXY amid US-EU tensions over Greenland. The US President’s tariff threats and Fed dovish signals on rate cuts are fueling volatility and pressuring the Greenback. In this article, Zeyphurs brokers examine the key aspects of the topic with clarity.

Dollar Weakens as Geopolitical Risk Intensifies

The US Dollar (USD) has started the week under notable pressure, underperforming against most of its major peers, as investors react to escalating political and trade tensions between Washington and Brussels. The catalyst behind the renewed volatility is a dispute over the United States’ intention to acquire Greenland, a move that has triggered sharp opposition from European Union (EU) leaders.

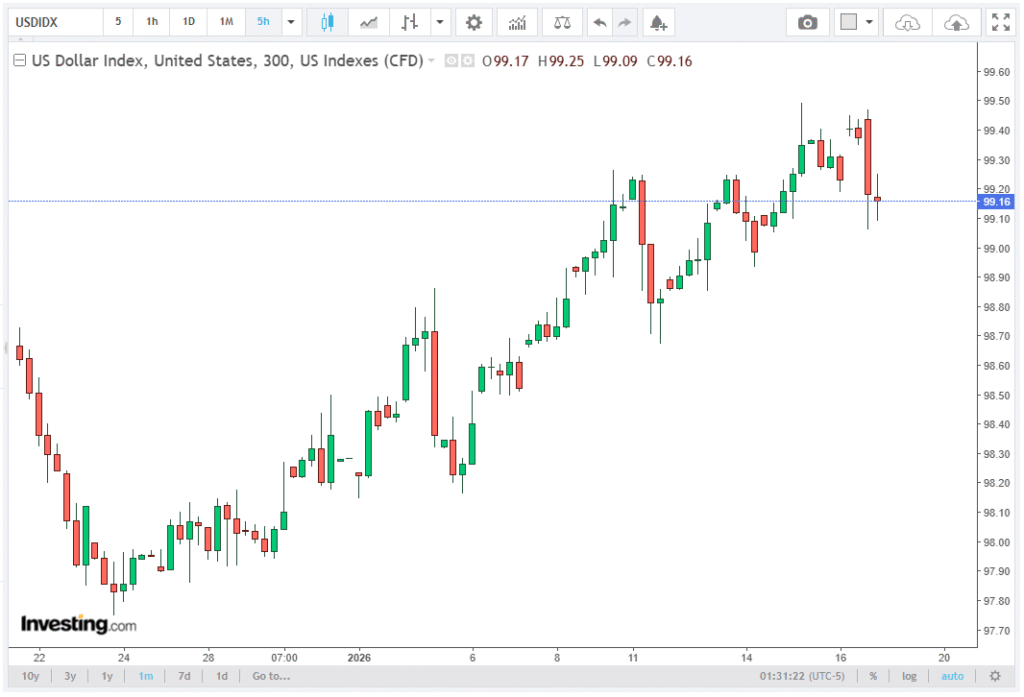

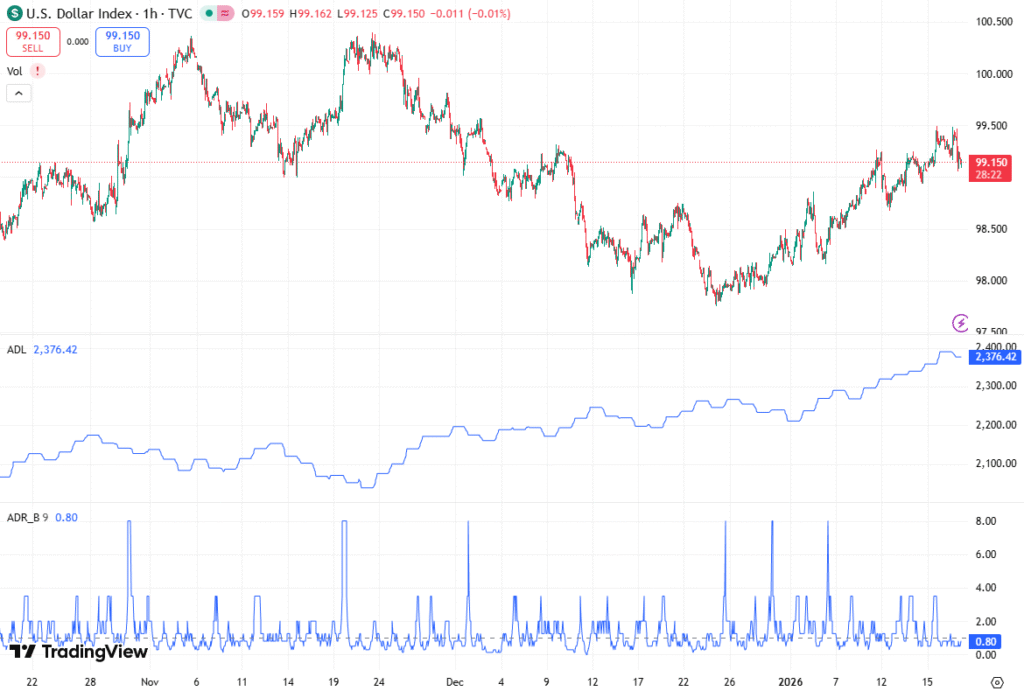

At the time of writing, the US Dollar Index (DXY), which measures the value of the Greenback against a basket of six major currencies including the Euro, Japanese Yen, and British Pound, has fallen around 0.25%, trading near 99.15, with intraday lows approaching 99.10. The decline reflects a growing risk premium being priced into the US currency amid uncertainty over transatlantic relations.

Tariff Threats and the Greenland Dispute

Over the weekend, the US President intensified the standoff by threatening to impose 10% tariffs on imports from several EU member states. The warning, delivered via a post on Truth Social, was aimed at countries opposing Washington’s plan for the “complete and total purchase of Greenland”, with the proposed tariffs set to take effect on February 1.

From a financial markets perspective, the threat of new trade barriers has revived concerns reminiscent of earlier trade war episodes, which historically undermined global growth expectations and weakened confidence in the US Dollar. Markets tend to view such unilateral tariff actions as USD-negative, particularly when they risk retaliatory measures and disrupt established trade flows.

The Greenland issue adds an additional layer of geopolitical complexity, as the territory holds strategic importance due to its natural resources, shipping routes, and defense positioning in the Arctic region.

EU Warns of a “Dangerous Downward Spiral”

Responding swiftly, European Commission President Ursula von der Leyen issued a strongly worded statement on X, cautioning that any attempt to challenge Greenland’s territorial integrity and sovereignty could seriously undermine international norms. She emphasized that such actions risk damaging the foundation of transatlantic cooperation, warning of a potential “dangerous downward spiral” in diplomatic and economic relations.

For currency markets, this rhetoric matters. A sustained deterioration in US-EU relations could encourage the Eurozone to accelerate efforts toward trade diversification, local-currency settlement mechanisms, or even broader de-dollarization strategies. While the US Dollar remains the world’s dominant reserve currency, repeated geopolitical confrontations raise long-term questions about its general acceptability in global trade and finance.

Implications for the US Dollar’s Reserve Status

Although any erosion of the USD’s reserve currency status would be gradual rather than abrupt, markets are sensitive to signals that major economic blocs may seek alternatives to dollar-based trade. Increased use of the Euro, Chinese Yuan, or bilateral currency agreements could, over time, reduce structural demand for the Greenback.

In the near term, the immediate impact is visible through portfolio flows, as investors rotate away from USD-denominated assets toward perceived safer or politically insulated currencies. This shift has amplified downside pressure on the DXY, already vulnerable due to domestic monetary policy expectations.

Fed’s Dovish Signals Add to Dollar Weakness

Compounding the geopolitical headwinds are increasingly dovish signals from the Federal Reserve. On Friday, Fed Vice Chair for Supervision Michelle Bowman stated that the central bank should be prepared to bring interest rates closer to their neutral level, citing fragile labor market conditions and lingering uncertainty in the employment outlook.

Bowman’s remarks reinforce market expectations for additional rate cuts, particularly if incoming data continue to show soft job creation, slowing wage growth, or declining labor force participation. Lower interest rates reduce the yield advantage of US assets, making the USD less attractive relative to currencies backed by tighter or more stable policy paths.

From a technical standpoint, expectations of monetary easing tend to weigh heavily on the US Dollar Index, especially when combined with external shocks such as trade disputes and geopolitical risk.

Outlook: Volatility Likely to Persist

Looking ahead, the trajectory of the US Dollar will depend heavily on how both sides manage the Greenland dispute and whether tariff threats evolve into concrete policy actions. Any signs of de-escalation could offer temporary relief to the Greenback, while further confrontational rhetoric may push the DXY decisively below the 99.00 psychological level.

At the same time, upcoming US economic data, Federal Reserve communications, and developments in global risk sentiment will remain critical drivers. For now, the combination of geopolitical uncertainty, trade tensions, and dovish Fed expectations suggests that the US Dollar Index may remain under pressure in the near term, with downside risks clearly dominating the outlook.