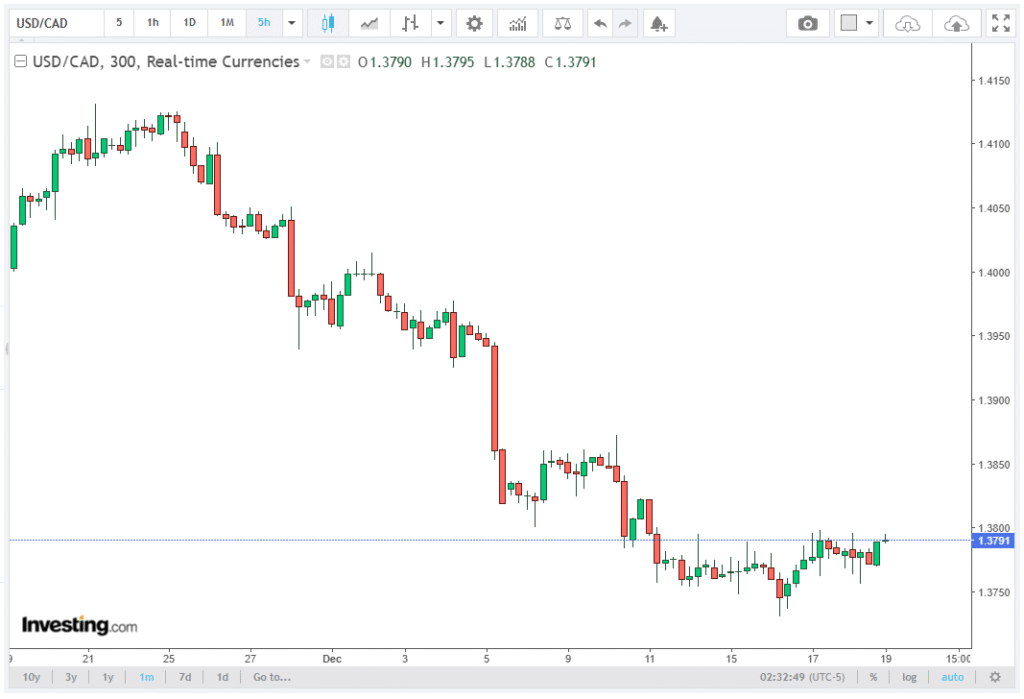

The USD/CAD pair trades slightly higher near 1.3790 in early European trading on Friday, reflecting a cautious rebound in the US Dollar (USD) following soft United States Consumer Price Index (CPI) data for November. Despite this modest uptick, the pair remains broadly sideways, unable to reclaim significant ground above the psychologically important 1.3800 level.

This article by Aurudium offers expert commentary and a complete explanation of the subject. Investors are weighing the implications of the recent US inflation report while awaiting Canadian Retail Sales data for October, which may provide further directional cues for the Loonie.

US Dollar Rebounds on Moderate Inflation

The US Dollar has regained momentum after the release of November’s CPI figures, which showed a moderate rise in headline inflation. The CPI came in at 2.7% year-on-year (YoY), down from 3% in October and below economists’ expectations of 3.1%. Meanwhile, the core CPI, which excludes volatile food and energy prices, decelerated to 2.6% YoY, missing consensus forecasts.

This softer-than-expected inflation reading has raised questions about the Federal Reserve’s policy trajectory, as slower price pressures may reduce the urgency for further monetary tightening. Nevertheless, the US Dollar Index (DXY) trades near 98.60, suggesting the Greenback retains overall support against a basket of major currencies.

The moderate inflation data initially caused some USD weakness, but technical buying and safe-haven demand pushed the USD/CAD pair back toward 1.3790.

Canadian Dollar Awaits Retail Sales Data

The Canadian Dollar (CAD) remains cautious ahead of October’s Retail Sales report, scheduled for 13:30 GMT. Analysts forecast that retail sales will remain flat every month, following a 0.7% decline in September.

The upcoming economic release is significant for the Bank of Canada (BoC) outlook, as consumer spending is a key driver of overall economic growth and inflationary trends. A stronger-than-expected reading could support the CAD and weigh on USD/CAD, while a disappointing result may allow the USD to extend gains.

Market participants are monitoring the retail sales data closely, as it could act as a catalyst for a near-term directional shift in USD/CAD, which has been range-bound below 1.3800 in recent sessions.

USD/CAD Technical Analysis

From a technical perspective, USD/CAD trades just below 1.3800, reflecting a sideways bias amid mixed fundamentals. The pair remains underneath the 20-day Exponential Moving Average (EMA), keeping the short-term trend slightly bearish. The downward slope of the EMA indicates persistent selling pressure on rallies.

The 14-day Relative Strength Index (RSI) sits at 35.09, edging near oversold territory, though it has recovered modestly from last week’s lows. Momentum remains fragile, suggesting that any upside attempts may face strong resistance near the 1.3800 threshold.

A sustained rebound would require a daily close above the 20-day EMA, which could reduce downside pressure and increase the likelihood of a move toward the round-level resistance of 1.3900. Conversely, a break below the August 7 low at 1.3720 would confirm continued weakness, potentially exposing the pair to further downside risk.

Key Support and Resistance Levels

Support levels to watch for USD/CAD include 1.3750, a short-term pivot near recent lows, and 1.3720, the August 7 swing low. Resistance levels include 1.3800, the immediate psychological barrier, and 1.3850–1.3900, a critical zone for potential upside extension.

Monitoring these technical levels alongside US and Canadian economic data will be crucial for traders seeking to gauge the pair’s near-term direction.

Market Outlook

The USD/CAD outlook remains broadly sideways, with the pair confined below 1.3800. The Greenback’s modest recovery is supported by soft US inflation and ongoing risk-on sentiment, but the Loonie is poised to react to upcoming Canadian Retail Sales figures.

Given the current technical setup, traders should remain alert to breakouts above 1.3800 or breakdowns below 1.3720, as these could signal the next trend phase. Until then, USD/CAD is likely to trade within a narrow range, reflecting the balance between US Dollar strength and Canadian economic resilience.

Conclusion

In summary, USD/CAD trades near 1.3790, rebounding modestly after softer-than-expected US CPI data. The pair remains technically capped below the 20-day EMA, suggesting sideways movement with a slightly bearish bias.

Market focus is now on Canadian Retail Sales, which may provide the next significant catalyst. Traders should monitor key technical levels at 1.3720 (support) and 1.3800–1.3900 (resistance) for potential breakouts or breakdowns. The pair’s near-term path is likely to remain range-bound, with volatility spikes linked to economic data releases and shifts in risk sentiment.

USD/CAD thus presents a sideways trading environment, with cautious upside potential if the 20-day EMA is decisively breached.