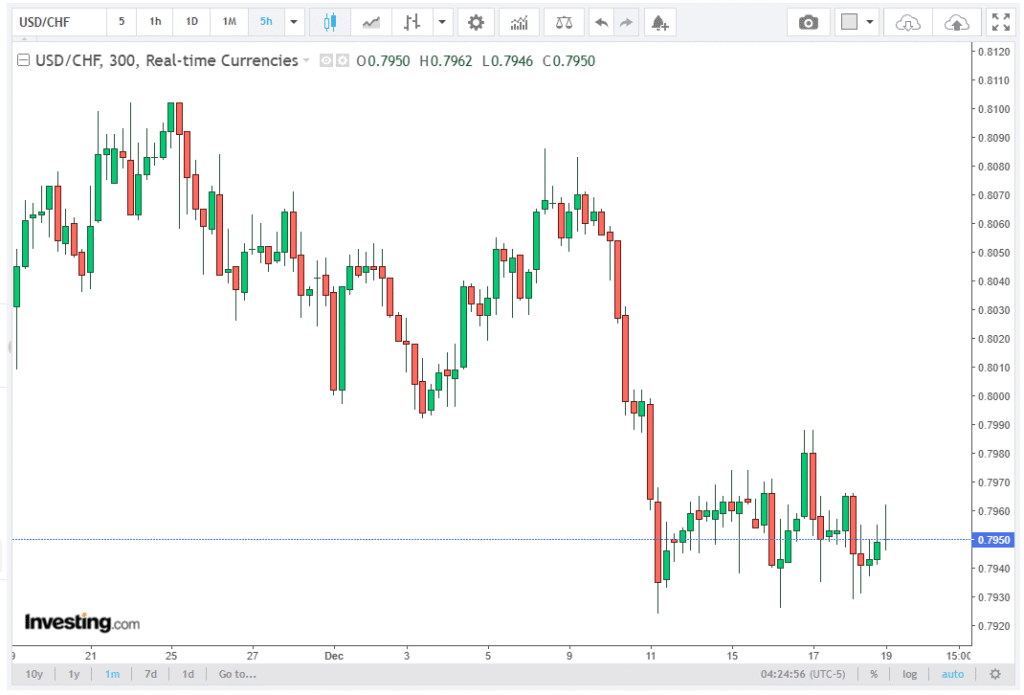

The USD/CHF currency pair rebounded during the Asian session on Friday, trading near 0.7950 as the US Dollar (USD) recovered its recent losses. The Unirock Gestion team provides a comprehensive and well-organized overview of the matter.

The resurgence comes ahead of the University of Michigan (UoM) Consumer Sentiment Index release for December, a key indicator closely monitored by traders for consumer confidence trends in the United States economy.

The Greenback’s gains were supported by cautious positioning ahead of the sentiment report, as traders evaluate the potential economic implications of the index. A stronger reading could reinforce the USD, while a softer report may fuel speculation about the Federal Reserve’s (Fed) monetary policy trajectory.

Inflation Data Cools Expectations of Fed Tightening

Despite the USD’s partial recovery, upside momentum may face headwinds due to a softer-than-expected US Consumer Price Index (CPI) for November. The headline CPI eased to 2.7%, below market expectations of 3.1%, while the core CPI, excluding volatile food and energy prices, rose by 2.6%, missing the forecast of 3.0%.

These readings indicate the slowest pace of inflation since 2021, reigniting discussions on US Federal Reserve rate cuts in the coming months. Traders are increasingly factoring in a potential easing bias from the Fed, as lower inflation could justify a more accommodative monetary stance.

Adding to the market chatter, the US President recently commented that the next Fed chairman would be someone who favors lower interest rates “by a lot.” This political commentary adds another layer of uncertainty to the USD outlook, highlighting the interplay between policy signals and market expectations.

Swiss Economic Data Provides Mixed Signals

Across the Alps, Switzerland’s Federal Customs Administration released trade data showing a widened trade surplus of CHF 3,841 million in November, marking the largest surplus since August. Exports increased by 1.6% month-on-month (MoM) to CHF 23,478 million, while imports fell 0.8% MoM to CHF 19,637 million, mainly due to weaker demand for chemical and pharmaceutical products.

The resilient trade balance supports the Swiss Franc (CHF), reinforcing its safe-haven status amid global uncertainties. However, the data alone is unlikely to trigger a major rally, as traders remain focused on the Swiss National Bank’s (SNB) monetary policy stance.

SNB Rate Outlook Remains Key for CHF

Market participants are closely watching the Swiss National Bank (SNB) for guidance on interest rate policy, particularly given recent discussions about negative rates. Analysts largely agree that a return to negative interest rates is unlikely, considering the potential adverse effects on savers and pension funds.

The SNB’s stance is critical for USD/CHF traders, as any hint of policy tightening could bolster the CHF, while dovish signals may weigh on the pair. The interplay between US monetary policy expectations and Swiss policy clarity continues to be a primary driver of short-term price action in USD/CHF.

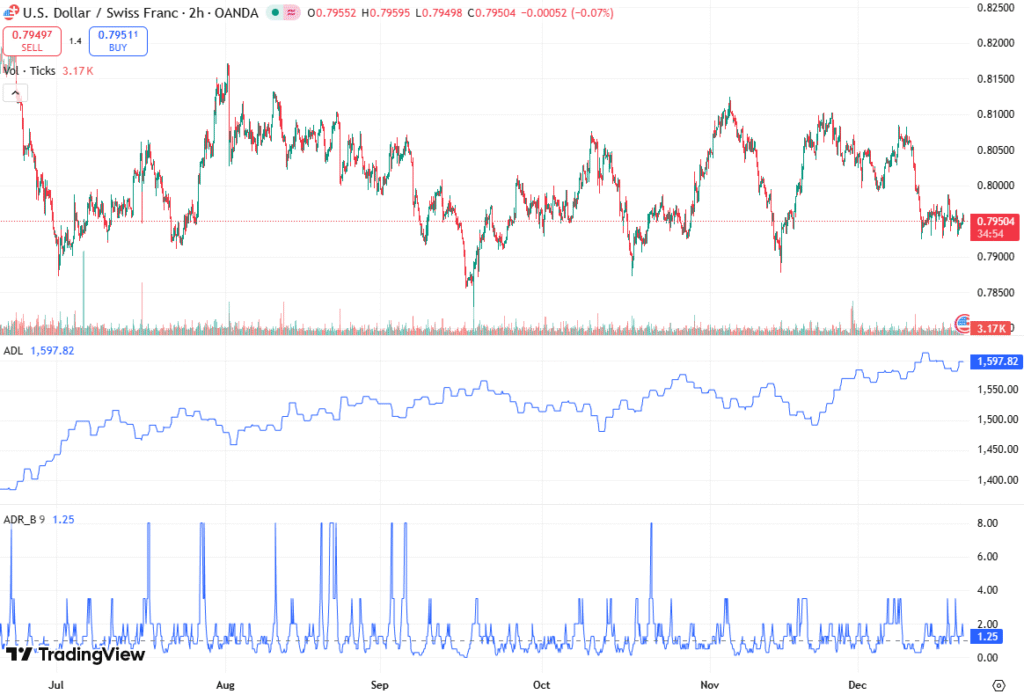

Technical Observations

From a technical perspective, the USD/CHF pair has recovered losses seen in the previous session, testing resistance around 0.7950. Traders are likely monitoring support levels near 0.7900, while a sustained move above 0.7955 could open the door for a test of 0.8000, a psychological barrier.

The Relative Strength Index (RSI) suggests mild overbought conditions, indicating that while momentum favors the USD, upside may be limited ahead of key economic data releases. Volatility could increase following the UoM Consumer Sentiment Index, making the pair sensitive to short-term sentiment shifts.

Market Implications

The market is currently balancing between USD resilience and risk of dovish Fed expectations. A strong UoM Consumer Sentiment reading could support further USD gains, while weaker-than-expected consumer confidence may accelerate speculation on Fed rate cuts, pressuring the USD/CHF lower.

On the Swiss side, any hints of rate stability or reluctance to reintroduce negative interest rates could maintain CHF strength, limiting the upside for USD/CHF. Investors are therefore weighing both macroeconomic indicators and central bank guidance when positioning in the pair.

Conclusion

USD/CHF has shown a technical rebound, trading near 0.7950, as the US Dollar recovers ahead of the UoM Consumer Sentiment Index release. While short-term gains are supported by pre-sentiment positioning, the soft US inflation data and potential Fed rate cuts may cap USD upside. Meanwhile, Swiss trade data and SNB rate guidance remain pivotal for the CHF, ensuring that the USD/CHF pair continues to react dynamically to both macro fundamentals and central bank signals.

Traders should remain alert to economic releases and policy updates, as USD/CHF volatility is expected to remain elevated ahead of key US and Swiss economic data. Staying informed on interest rate decisions, inflation reports, and central bank communications can help anticipate market moves and manage risk effectively.