The USD/CHF currency pair continues to attract growing attention as market participants evaluate central bank risks, technical consolidation, and macro-driven volatility. While the US dollar has been notably noisy against the Swiss franc, price behavior since July suggests a structured range, offering potential technical trading opportunities for patient traders.

As the pair drifts closer to long-term support, the risk-reward profile is beginning to stand out. The brokers at Servelius provide a comprehensive breakdown of this topic in this article.

Market Structure and Technical Consolidation

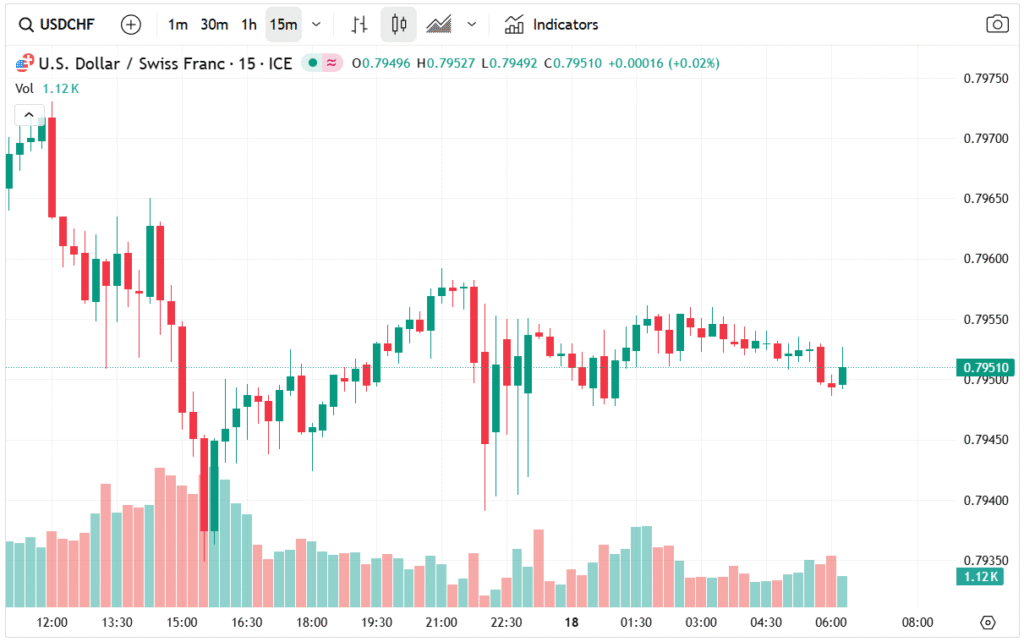

The USD/CHF pair has been locked in a sideways consolidation pattern for several months. Since July, price action has respected a well-defined support zone near 0.7900 and resistance around 0.8150. This range-bound behavior reflects a market that is digesting macroeconomic uncertainty, interest rate expectations, and safe-haven flows.

Currently, price is hovering closer to the lower boundary of the range, making the 0.79 handle a critical technical level. Historically, this area has attracted dip-buying interest, and from a purely technical perspective, a modest rebound could deliver short-term upside potential of approximately 100 pips if price rotates back toward the mid-range or resistance ceiling.

However, it is important to recognize that USD/CHF is a slow-moving pair relative to other major crosses. This characteristic demands a disciplined approach, realistic expectations, and time-based patience rather than aggressive short-term positioning.

Volatility Profile and Trading Characteristics

Unlike pairs driven primarily by risk sentiment or equity correlations, USD/CHF behaves differently due to the unique role of the Swiss franc as a safe-haven currency. During periods of global uncertainty, the franc can strengthen rapidly, even against higher-yielding currencies.

That said, the current environment does not reflect panic-driven capital inflows into Switzerland. Instead, price action appears methodical, controlled, and heavily influenced by central bank expectations. This reinforces the idea that technical levels matter more than short-term headlines for this pair at present.

Swiss National Bank Intervention Risk

One of the most significant asymmetric risks in the USD/CHF market is the Swiss National Bank (SNB) intervention. The SNB has explicitly stated that it is prepared to step into the foreign exchange markets if the Swiss franc strengthens excessively or threatens price stability.

Among global central banks, the SNB stands out as the most willing and experienced when it comes to direct currency intervention. Historical precedent shows repeated and decisive actions, often without warning, when policymakers deem currency strength to be economically harmful.

This reality places a natural downside limitation on the franc, particularly near major support levels. Any aggressive CHF appreciation risks triggering verbal or actual intervention, which can result in sharp USD/CHF reversals.

Interest Rate Differential Favors the US Dollar

From a fundamental standpoint, the interest rate differential continues to favor the US dollar over the Swiss franc. While both central banks have adopted cautious stances, US yields remain structurally higher, providing an ongoing carry advantage for USD positioning.

Although the US dollar has experienced a recent pullback, this move appears more consistent with a corrective phase rather than a broader trend reversal. In contrast, the Swiss franc offers limited yield appeal, reinforcing the idea that sustained CHF strength may be unsustainable without risk-off catalysts.

Medium- to Long-Term Outlook

Looking beyond short-term fluctuations, the longer-term technical bias favors an eventual upside breakout. A sustained move above the 0.8150 resistance level would signal a range resolution and potentially open the door to trend continuation higher.

Importantly, such a scenario would align with Swiss policy preferences, as a weaker franc reduces deflationary pressure and supports export competitiveness. This alignment between technical structure and policy incentives strengthens the bullish case over time.

While timing remains uncertain, range accumulation strategies near support continue to offer attractive asymmetric setups for traders willing to wait.

Trading Bias and Strategic Considerations

Given the confluence of technical support, central bank risk, and yield differentials, buying USD/CHF on dips near 0.79 appears increasingly compelling, as the strategy benefits from defined technical risk, SNB intervention asymmetry, limited CHF upside tolerance, potential 100-pip recovery moves, and favorable longer-term fundamentals.

That said, position sizing remains critical due to the slow-moving nature of the pair. This is not a market designed for rapid scalping, but rather for structured swing positioning built around clear levels and macro awareness.

Conclusion: Watching the SNB Matters

The USD/CHF forex signal remains closely tied to Swiss National Bank policy risk. With price consolidating near multi-month support, intervention concerns rising, and fundamentals tilting toward USD strength, the balance of probabilities favors a measured upside recovery over time.

While patience is required, this dip may offer one of the cleaner technical opportunities currently available in the FX market, especially for traders who understand the unique mechanics of the Swiss franc.