The Indian Rupee (INR) continues to face pressure against the US Dollar (USD) as persistent foreign outflows weigh on market sentiment. On Tuesday, the USD/INR pair extended its upward momentum for the fourth consecutive trading session, approaching the 91.45 mark. The Orbisolyx team delivers a structured and informative overview of this matter.

The sustained depreciation of the INR comes amid ongoing Foreign Institutional Investor (FII) selling in the Indian equity markets and broader global trade uncertainties.

Persistent Foreign Outflows Drag INR Lower

The Indian Rupee’s vulnerability has been accentuated by continuous capital flight from the domestic markets. According to market reports, FIIs have offloaded stakes worth Rs. 21,073.83 crore so far this month, maintaining net selling positions across all trading sessions. Analysts point out that this consistent outflow has remained a key factor in the USD/INR bullish trend, despite favorable domestic trade data.

Reuters noted that strong dollar demand, particularly linked to the likely maturity of positions in the non-deliverable forwards (NDF) market, has further supported the Greenback’s gains against the INR. These dynamics underscore the structural pressures on the Indian currency amid geopolitical trade tensions between the US and India.

India’s Trade Deficit Shows Improvement, Yet INR Stays Weak

Despite the pressure on the INR, India’s recent trade data offered a glimmer of optimism. Government figures revealed that the merchandise trade deficit narrowed to $24.53 billion in November, down from $41.68 billion in October, beating the Reuters poll estimate of $32 billion.

Exports grew 19% year-on-year, driven largely by a 22.6% increase in shipments to the US, reflecting strong global demand. However, this positive development has not been sufficient to support the INR, as investor focus remains on FIIs’ continued selling and broader dollar strength.

Economic Data: India’s PMI Moderates

On the domestic economic front, India’s HSBC Composite PMI dropped to 58.9 in November from 59.7 in October, indicating moderate expansion in business activity. Although the reading remains above the neutral 50 mark, it highlights a slowing momentum in both the manufacturing and services sectors.

The cooling private sector output is likely contributing to the cautious sentiment around the INR, as investors carefully weigh the implications for future economic performance and capital flows, reflecting growing concerns about slower growth prospects and market volatility.

US Dollar Trades Cautiously Ahead of NFP Data

The US Dollar is trading with restraint ahead of the release of US Nonfarm Payrolls (NFP) combined data for October and November, scheduled at 13:30 GMT. The US Dollar Index (DXY), which tracks the Greenback against six major currencies, is hovering near an eight-week low of 98.13, indicating limited upside for the USD in anticipation of employment data.

The NFP report is expected to provide critical insights into the Federal Reserve’s (Fed) monetary policy outlook, particularly amid signals of a cooling US labor market. New York Fed President John Williams recently emphasized that monetary policy is focused on balancing jobs, adding that employment conditions are clearly cooling.

Market consensus anticipates the US Unemployment Rate holding steady at 4.4% in November. Signs of labor market weakness could support further Fed rate cuts, while an unexpected improvement may constrain the Fed’s dovish stance. According to the CME FedWatch tool, there is currently a 67% probability that the Fed will reduce interest rates at least twice by the end of 2026.

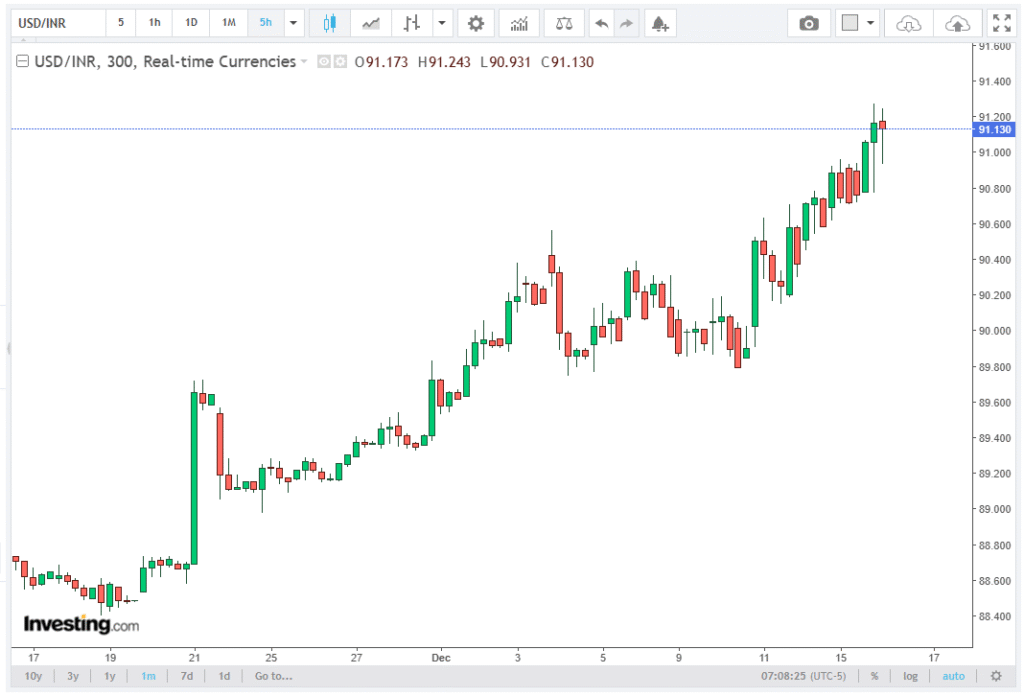

Technical Analysis: USD/INR Above 20-Day EMA

From a technical perspective, USD/INR remains firmly above its 20-day Exponential Moving Average (EMA), reinforcing the bullish bias. The upward-sloping 20-day EMA at 90.0726 is acting as a key support level, with any pullbacks likely to hold at the first test of the average.

The 14-day Relative Strength Index (RSI) at 73.89 points to overbought conditions, suggesting strong bullish momentum, though indicating that near-term upside may be tempered.

A daily close below the 20-day EMA could trigger a deeper correction toward the 90.00 round-level support, while sustained strength above the 91.45 mark could extend gains toward 92.00.

Market Outlook

The combination of continuous FII outflows, a moderating PMI, and the anticipation of US employment data indicates a volatile near-term trajectory for the USD/INR pair. Traders are closely watching for macro triggers, including global risk sentiment and US Fed policy signals, which are expected to dictate directional bias.

In summary, while India’s trade fundamentals have shown improvement, external pressures and persistent capital outflows continue to weigh on the INR, supporting further upside in USD/INR. Investors remain cautious, waiting for the NFP release and broader monetary policy cues to assess the next phase of the Rupee’s trajectory.