The Indian Rupee (INR) staged a sharp recovery against the US Dollar (USD) on Wednesday, following intervention by the Reserve Bank of India (RBI) in both the spot and Non-deliverable Forward (NDF) markets.

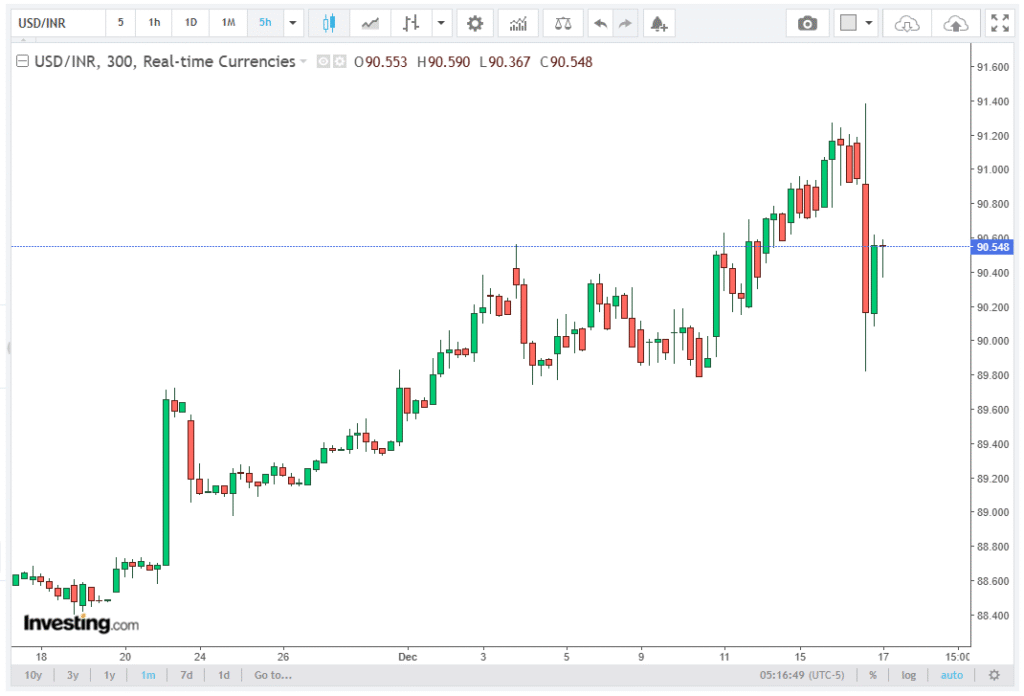

The USD/INR pair fell over 1%, dipping to near 90.00 from its all-time high of 91.56, signaling a strong corrective move after weeks of selling pressure. This article from Tarillium offers readers a clear and thorough explanation of the subject.

RBI Intervention Supports the Rupee

Market sources reported that state-run banks were offering U.S. dollars aggressively, likely on behalf of the RBI, in an effort to stabilize the currency. The central bank had been expected to intervene to support the domestic currency, which remained the worst-performing Asian currency against the US Dollar this year, down almost 6.45% YTD.

The persistent weakness in the INR was fueled by foreign fund outflows and the absence of a breakthrough in US-India trade negotiations. Indian importers’ increasing demand for US Dollars amid the ongoing trade stalemate also added pressure on the domestic currency.

So far in 2025, Foreign Institutional Investors (FIIs) have remained net sellers in seven out of 11 months, highlighting cautious sentiment in the equity markets. In December, FIIs offloaded stakes worth Rs. 23,455.75 crore, further weighing on the INR.

On the monetary policy front, RBI Governor Sanjay Malhotra indicated that interest rates would “remain low for a longer period.” He described the recent GDP growth as “surprising,” prompting the central bank to improve its forecasting models.

US Dollar Eyes CPI Data Amid Mixed Economic Signals

While the INR rallied on RBI support, the US Dollar (USD) extended its recovery during Asian trading hours. The US Dollar Index (DXY), which tracks the Greenback against six major currencies, climbed 0.17% to near 98.40, bouncing back from an eight-week low of 98.00.

Recent US economic data painted a mixed picture. The combined Nonfarm Payrolls (NFP) report for October and November showed the Unemployment Rate at 4.6%, the highest since September 2021. The economy shed 105K jobs in October but added 64K in November, signaling sluggish labor market conditions.

Other data points, including Retail Sales for October and preliminary S&P Global PMI for December, remained underwhelming. Month-on-month Retail Sales were flat, below expectations of 0.1% growth, while the Composite PMI fell to 53.0, down from 54.2 in November.

Despite these soft economic indicators, experts suggest that the data is unlikely to alter Federal Reserve (Fed) policy in the near term, noting distortions caused by the recent government shutdown. According to the CME FedWatch Tool, the Fed is expected to hold interest rates steady at its January 2026 policy meeting, keeping monetary conditions broadly unchanged.

Impact of Global Risk Sentiment and Oil Prices on USD/INR

Market participants are also keeping an eye on global risk sentiment, as geopolitical developments and oil price movements could further influence the USD/INR pair. Any shifts in capital flows or crude oil volatility are likely to impact the Rupee, given India’s import dependence on energy.

Traders may use these cues alongside technical levels and macro data to adjust positions, especially as the RBI and Fed continue to set the tone for currency and interest rate dynamics.

Technical Analysis: USD/INR Holds Above Key EMA

From a technical perspective, the USD/INR trades at 90.5370, maintaining a bullish bias as it remains above the rising 20-day Exponential Moving Average (EMA) at 90.1278. This level acts as immediate support, and sustained trading above it signals potential for further upside momentum.

The Relative Strength Index (RSI) stands at 59.23, comfortably above the 50 midline, confirming positive momentum after retreating from overbought levels. Initial support zones are anchored around the 20-EMA cluster, spanning 89.9556–89.8364. A daily close below this zone would shift the bias toward consolidation, whereas maintaining bids above it could pave the way for further gains.

Despite the recent correction, trend conditions remain firm, with pullbacks expected to be contained as long as the moving-average support holds. Traders are likely to monitor key technical levels, including the 20-day EMA and psychological round numbers, for potential entry and exit points.

Outlook

The combination of RBI intervention and ongoing foreign fund outflows makes the INR volatile in the near term. While the USD/INR correction has provided relief, market participants remain cautious ahead of US CPI data and potential policy shifts from the Fed.

In summary, the Indian Rupee’s sharp rebound reflects proactive RBI intervention, while the US Dollar continues to react to mixed economic signals. Traders should closely watch key technical levels and upcoming macro data, including US CPI, for clues on the next directional move in USD/INR.