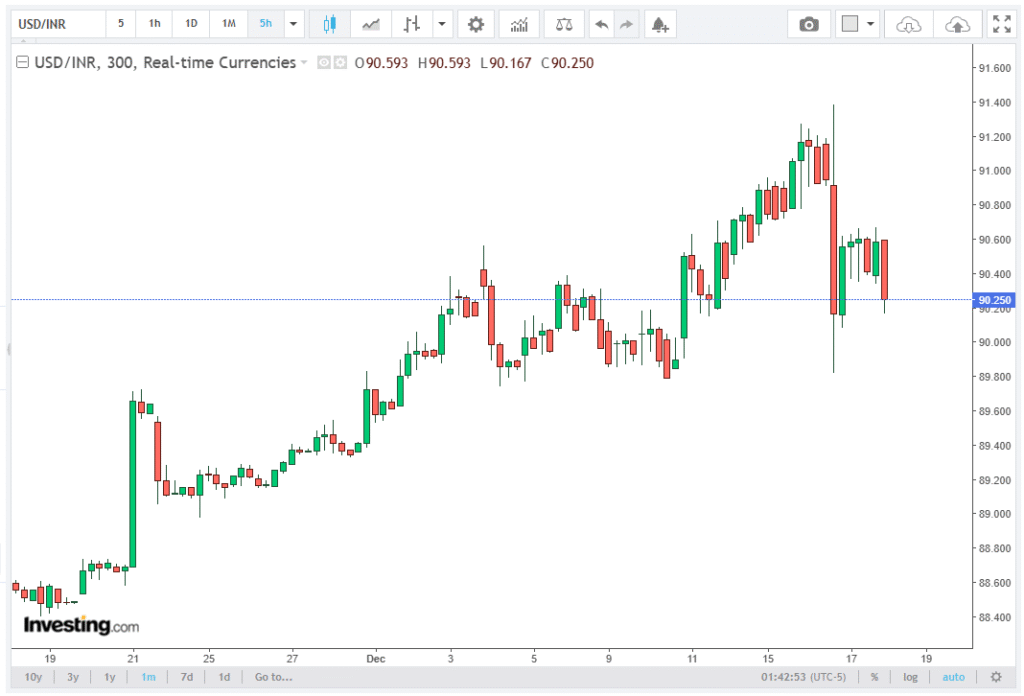

The Indian Rupee (INR) strengthens slightly against the US Dollar (USD) after a flat opening on Thursday, building on the strong rebound recorded in the prior session. The USD/INR pair slips back toward the 90.50–90.80 range, with market participants factoring in a high likelihood of ongoing intervention by the Reserve Bank of India (RBI).

This renewed optimism has helped cool speculative pressure after the pair recently touched record highs near 91.55. In this article, Servelius brokers examine the key aspects of the topic with clarity and depth.

Market participants believe that the central bank’s resolve to defend excessive volatility could keep the pair capped in the near term. According to traders cited by Reuters, there is a strong likelihood that the RBI may step in again to smooth currency movements and prevent disorderly depreciation.

RBI Intervention Anchors Rupee Sentiment

On Wednesday, the Reserve Bank of India (RBI) took strong action by offloading US Dollars across the spot and non-deliverable forward (NDF) markets.

This decisive action successfully interrupted the one-way rally in USD/INR, which had been driven by persistent capital outflows and global dollar strength. The intervention signaled the central bank’s discomfort with rapid and speculative moves rather than any specific exchange rate level.

Such follow-through intervention often has a strong psychological impact. It discourages leveraged long positions in USD/INR and reassures importers and corporates that the RBI is willing to deploy reserves when volatility becomes excessive.

Despite the recent bounce, the Indian Rupee has underperformed the US Dollar for an extended period. Persistent capital outflows, geopolitical uncertainty, and trade-related concerns have weighed heavily on the currency. The structural demand for dollars from importers and foreign investors continues to keep USD/INR biased upward, even as tactical pullbacks emerge following RBI action.

Therefore, while intervention-led recoveries can be sharp, they often struggle to evolve into long-lasting trends unless supported by fundamental improvements, such as stronger trade flows or sustained portfolio inflows.

The US President Signals a More Dovish Future Fed

Global factors are also influencing USD/INR dynamics. The US Dollar trades cautiously ahead of the US Consumer Price Index (CPI) data for November, scheduled for release at 13:30 GMT. At the time of writing, the US Dollar Index (DXY) hovers near 98.45, slightly higher but lacking strong directional momentum.

Economists expect headline US inflation to rise to 3.1% year-on-year, up from 3% in October, while core CPI is forecast to remain steady at 3%. These figures will shape expectations for the US interest rate outlook.

However, broader dollar sentiment has softened following comments from the US President, who suggested that the next Federal Reserve Chairman would favor aggressive interest rate cuts. The US President stated that his nominee would support significantly lower rates, aligning monetary policy more closely with his economic agenda. Such remarks have reignited concerns over Federal Reserve independence, a factor that typically weighs on the US Dollar.

Fed Policy Expectations and Market Positioning

Although the DXY rebounded from a 10-week low near 98.00, traders remain cautious about pricing in aggressive rate cuts. According to the CME FedWatch tool, the probability of a 25 basis point rate cut in the January policy meeting stands at 24.4%. Fed Chair Jerome Powell recently emphasized that the bar for further easing is very high, keeping near-term dovish bets in check.

Even so, expectations that Powell’s successor could adopt a more accommodative stance have capped upside potential for the Greenback, indirectly supporting emerging market currencies like the INR.

Technical Analysis: USD/INR Holds Key 20-Day EMA

From a technical perspective, USD/INR trades lower near 90.50, but the broader bullish bias remains intact. The pair continues to hold above the rising 20-day Exponential Moving Average (EMA), currently positioned at 90.2106. The upward slope of this EMA suggests that pullbacks are being absorbed, rather than triggering trend reversals.

The 14-day Relative Strength Index (RSI) stands at 63.40, remaining firmly in bullish territory after cooling from overbought levels. This indicates healthy momentum rather than exhaustion.

As long as daily closes stay above the 20-day EMA, bulls are expected to retain control. A decisive break below this support could open the door for a deeper retracement toward the September 24 high near 89.12. On the upside, a move above Wednesday’s peak at 91.55 would likely reignite upside momentum, potentially pushing the pair toward the 92.00 psychological level.

Conclusion

The USD/INR pullback reflects a combination of RBI intervention hopes, temporary FII inflows, and softer US Dollar sentiment. While near-term risks have moderated, the medium-term outlook remains sensitive to global monetary policy shifts, trade developments, and capital flow dynamics. For now, the RBI’s proactive stance has provided the Rupee with much-needed breathing space.