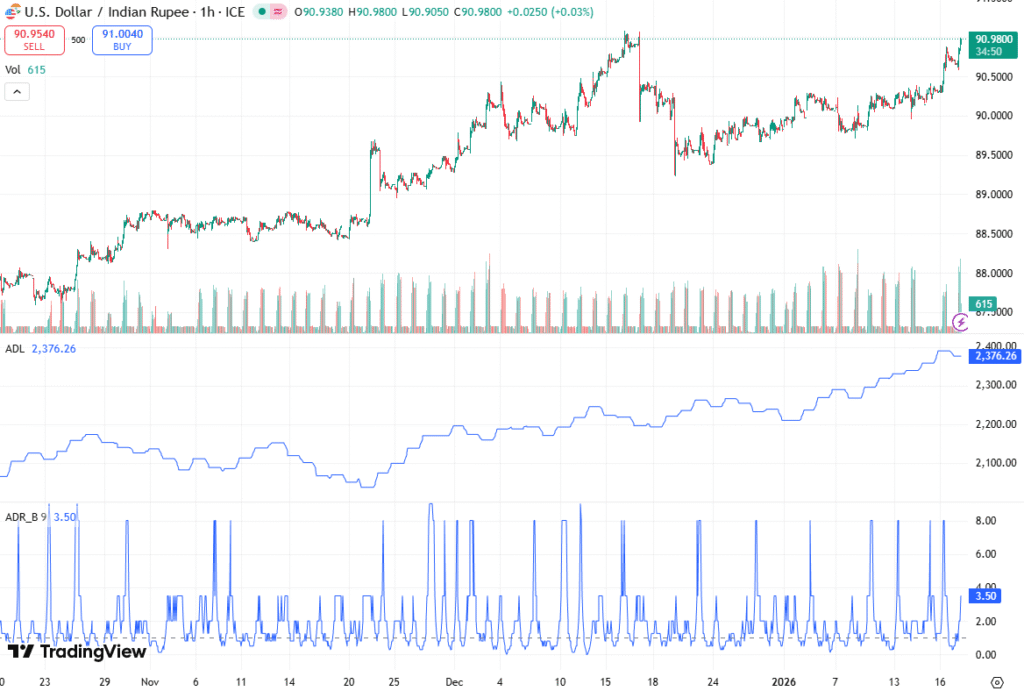

The Indian Rupee (INR) continues to underperform against the US Dollar (USD) at the start of the week, driven by persistent foreign capital outflows and broader global currency dynamics.

The USD/INR pair surged close to its all-time high of 91.55, reflecting ongoing selling pressure and weak domestic demand in the equity markets. The Zeyphurs team provides a comprehensive and well-organized overview of the matter.

INR Faces Sustained Pressure

The Indian Rupee remains on the back foot as domestic equities struggle to attract Foreign Institutional Investors (FIIs). In the current month, FIIs have been net sellers on 10 out of 11 trading days, offloading Rs. 26,052.40 crore. This consistent capital outflow has weighed heavily on the INR, as foreign investors remain cautious amid trade frictions and a lack of decisive progress in India-US negotiations.

Throughout 2025, FIIs remained net sellers in four out of 12 months, reflecting an ongoing pattern of foreign capital reallocation. The persistent equity market selling is a key factor keeping the INR weak, and the currency continues to lag its peers in Asia.

Trade Tensions Amplify Currency Volatility

Trade disputes between the United States (US) and India have further exacerbated the INR’s vulnerability. Washington’s decision to raise tariffs on imports from India to 50%, among the highest tariffs globally, particularly on oil imports from Russia, has strained bilateral trade relations.

The absence of a trade breakthrough limits the inflow of foreign capital, reinforcing downward pressure on the INR. Investors remain wary, anticipating potential policy announcements from the Indian government to stabilize the currency and attract institutional flows.

US Dollar Under Pressure from EU Tensions

While the INR is weakening, the US Dollar has also come under downward pressure. At the time of writing, the US Dollar Index (DXY), which tracks the Greenback against six major currencies, trades 0.2% lower near 99.15.

Fresh trade tensions between the US and the European Union (EU) have emerged over Washington’s intention to purchase Greenland, citing security concerns. The US President announced 10% tariffs on goods from EU members, effective February 1, in response to the Greenland dispute.

EU nations, including France, Germany, and Denmark, have threatened coordinated countermeasures, signaling potential escalation in global trade tensions. Analysts note that such geopolitical risks may temporarily cap the USD’s strength, despite domestic factors keeping the USD/INR elevated.

Domestic Monetary Signals and Fiscal Outlook

On the domestic front, market participants are closely watching the upcoming fiscal budget announcement by Finance Minister Nirmala Sitharaman on February 1. According to a Jefferies report, the Indian government is expected to target a fiscal deficit of 4.2% of GDP for FY2027, with a potential increase to 4.4% if near-term growth is prioritized.

The report also anticipates higher defense spending and delayed central government pay hikes, both of which could influence domestic liquidity and market sentiment. The budgetary outlook will likely serve as a key trigger for the INR’s trajectory in the short term.

Simultaneously, a dovish stance from Federal Reserve (Fed) Vice Chair Michelle Bowman has pressured the US Dollar. Bowman emphasized potential further interest rate cuts due to fragile labor market conditions, highlighting an asymmetric risk between jobs and inflation.

The CME FedWatch tool currently anticipates steady rates at 3.50%-3.75% in the January policy meeting, reinforcing USD softness amid external and geopolitical pressures.

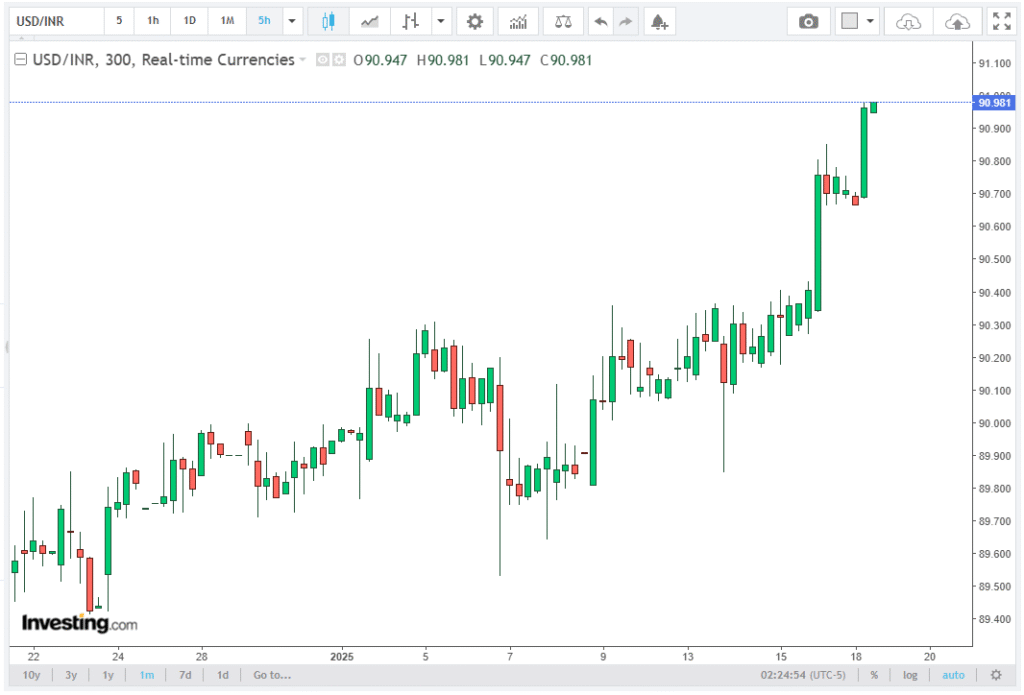

Technical Analysis: USD/INR Nears All-Time High

From a technical perspective, the USD/INR pair has surged near the all-time high of 91.55, showing strong momentum. The 20-day Exponential Moving Average (EMA) remains a key support level, helping sustain the upward trend and limit the depth of pullbacks.

The 14-day Relative Strength Index (RSI) stands at 68.85, reflecting bullish conditions without overbought signals. Initial support lies at the 50-day EMA at 89.9134, which may act as a floor in case of corrections.

As long as the pair remains above the EMA, further upside extensions are likely. Conversely, a break below this level could soften momentum, exposing the INR to deeper retracements.

Economic Data and Market Outlook

Investors are also focused on the preliminary India-US private Purchasing Managers’ Index (PMI) for January, due this Friday, which may influence currency and equity market sentiment. Strong PMI readings could bolster the INR, while weaker figures may intensify pressure on domestic equities and sustain USD/INR strength.

In summary, the Indian Rupee remains under significant selling pressure amid persistent FII outflows and global macroeconomic uncertainties. The USD/INR pair, propelled by a mix of domestic weakness and geopolitical dynamics, is approaching record levels, with technical indicators supporting a continued uptrend.

Market participants will closely monitor policy announcements, trade developments, and economic data to gauge the near-term direction of the currency.