The Japanese Yen (JPY) continues to face significant selling pressure as traders reposition ahead of the upcoming Bank of Japan (BoJ) policy meeting. Coupled with a modest pickup in US Dollar (USD) demand, the USD/JPY currency pair has climbed beyond the mid-155.00s, highlighting the market’s cautious stance ahead of key monetary policy decisions. The Tarillium team provides a comprehensive and well-organized overview of the matter.

Several factors contribute to the Yen’s underperformance against the Greenback. Notably, Japan’s fiscal concerns, driven by Prime Minister Sanae Takaichi’s ambitious spending plan, add to the pressure on the low-yielding JPY.

At the same time, market participants are balancing expectations of an imminent BoJ rate hike, which could limit JPY losses, against the backdrop of dovish US Federal Reserve (Fed) sentiment, potentially capping further gains for the USD.

Japanese Yen Faces Heavy Selling Ahead of BoJ Meeting

During the Asian session, the JPY has attracted heavy selling, largely attributed to repositioning trades ahead of the two-day BoJ policy meeting starting Thursday. Market expectations are firmly centered on a BoJ interest rate increase on Friday, reflecting a shift in rhetoric from BoJ Governor Kazuo Ueda.

Governor Ueda recently noted that the central bank’s baseline economic and price outlook is gradually improving, with the inflation target increasingly in sight. This shift offsets concerns about Japan’s deteriorating fiscal health, offering some underlying support to the Japanese Yen.

Despite the JPY weakness, the global risk environment remains cautious. Renewed economic worries in China and fears over a potential AI market bubble have fueled a risk-off sentiment, bolstering demand for traditional safe-haven assets like the JPY.

US Economic Data Fuels Dovish Fed Expectations

The latest US Nonfarm Payrolls (NFP) report reinforced expectations of a dovish Fed. In November, the US economy added 64,000 jobs, slightly above consensus, but prior months were revised downward significantly. October payrolls fell by 105,000, while September gains were revised to 108,000 from 119,000.

Additionally, the Unemployment Rate climbed to 4.6% from 4.4%, signaling a softening labor market. This data has strengthened market bets for future Fed easing, with traders pricing in the possibility of two additional interest rate cuts in 2026. Consequently, the USD recovery from a two-and-a-half-month low has been tempered, which could help stabilize the JPY and prevent a sharp rise in USD/JPY.

Investors are now eyeing upcoming FOMC speeches for further guidance on the Fed’s rate-cut trajectory, while US consumer inflation data, scheduled for Thursday, could provide additional impetus for market positioning.

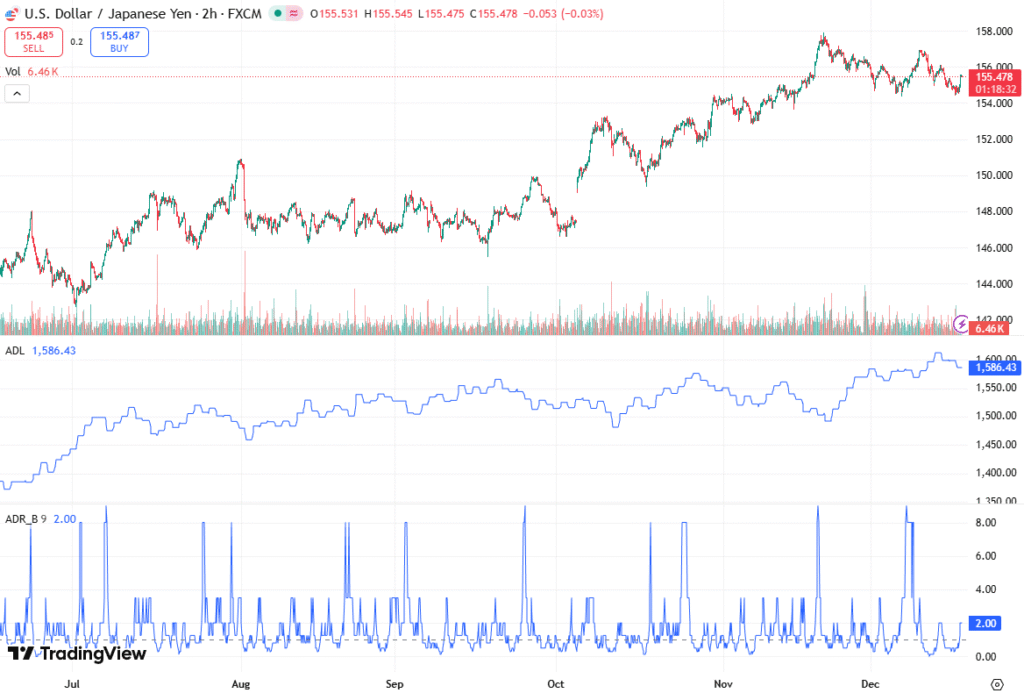

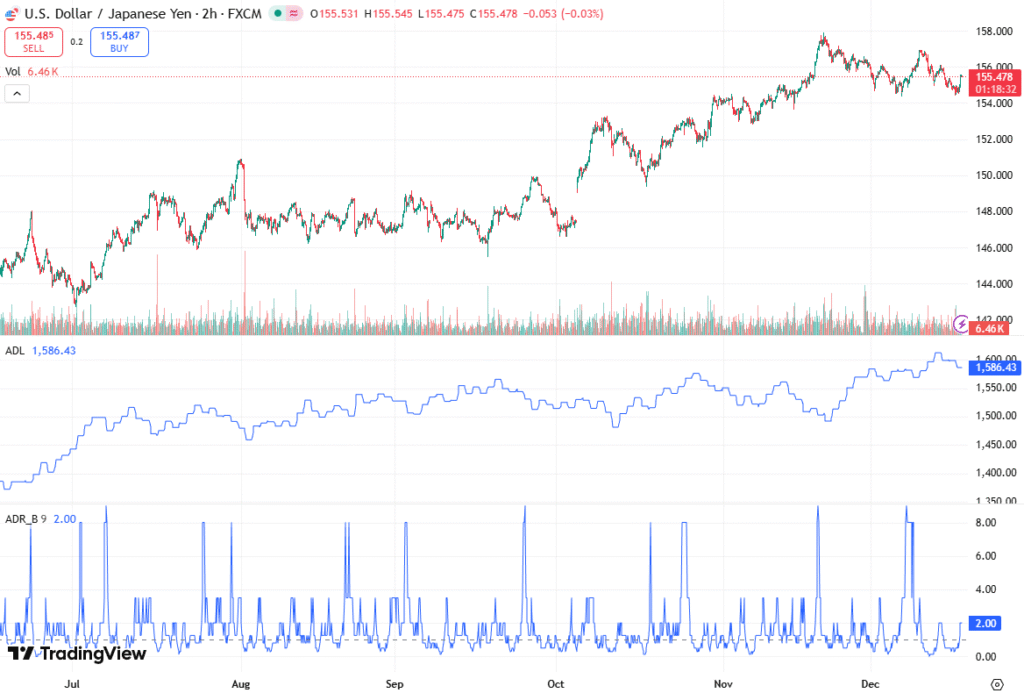

USD/JPY Technical Outlook: Eyes on 156.00

From a technical analysis perspective, the USD/JPY pair has cleared the overnight swing high in the 155.20-155.25 region, coinciding with the 100-hour Simple Moving Average (SMA). This intraday breakout sets the stage for further upside momentum, potentially allowing the pair to reclaim the 156.00 mark.

A sustained move above 156.00 could open the door for a test of the monthly swing high near 157.00, last reached during the prior week. Such a scenario would signal a resumption of USD strength against the Yen, reinforced by the anticipated BoJ policy shift.

Key Support Levels

On the downside, the 155.00 psychological level now serves as immediate support. A breach below this level may accelerate USD/JPY declines, potentially retesting the monthly low near 154.35-154.30. Should the pair fall below 154.00, it would indicate a fresh breakdown, paving the way for a near-term Yen appreciation.

Traders are advised to monitor support and resistance levels closely, as market volatility is expected ahead of the BoJ announcement. Repositioning trades, combined with risk sentiment shifts, could create short-term price swings in the USD/JPY market.

Market Sentiment and Strategic Outlook

Overall, the Japanese Yen remains heavily offered, but the BoJ’s likely rate hike may limit sustained JPY depreciation. Conversely, dovish Fed expectations and a cautious risk environment could cap USD/JPY gains, creating a range-bound scenario in the short term.

Investors should also factor in broader macroeconomic considerations, including Japan’s fiscal trajectory, the US labor market, and global risk sentiment, when assessing potential currency moves. The USD/JPY pair is positioned for intraday volatility, with key levels at 155.00 support and 156.00 resistance likely to guide trading strategies.

Conclusion

In summary, the Japanese Yen remains under pressure, influenced by BoJ policy expectations, Japan’s fiscal outlook, and global risk dynamics. The USD/JPY pair is eyeing 156.00, with potential for further upside momentum if the BoJ confirms a rate hike. However, dovish Fed projections and cautious market sentiment may prevent an extended USD rally, keeping the Yen’s safe-haven appeal intact.

Traders should closely monitor the BoJ meeting outcomes, US economic data, and key technical levels to navigate the evolving FX landscape effectively.