AppLovin (APP), a leading player in the mobile marketing platform space, had a solid finish to 2025. However, despite reporting impressive fourth-quarter results, the company’s stock has experienced a sharp drop in after-hours trading.

Analysts at Auralyex had expected a strong performance, but the market’s reaction reveals a different sentiment. Here’s a closer look at what’s driving the sell-off and what investors should consider moving forward.

Q4 2025 Results: Beating Expectations but Falling Short of Market Expectations

AppLovin’s fourth-quarter 2025 results were robust, with revenue reaching $1.66 billion, a 66% year-over-year increase. The company also posted diluted earnings per share (EPS) of $3.24, reflecting an impressive 87% year-over-year increase. Both figures beat analysts’ expectations, which were set at $1.61 billion in sales and EPS of $2.94.

On the cash flow front, AppLovin generated free cash flow of $1.31 billion, up from $695.2 million during the same period in 2024. This strong cash flow performance reflects AppLovin’s growing efficiency and ability to generate cash from its operations.

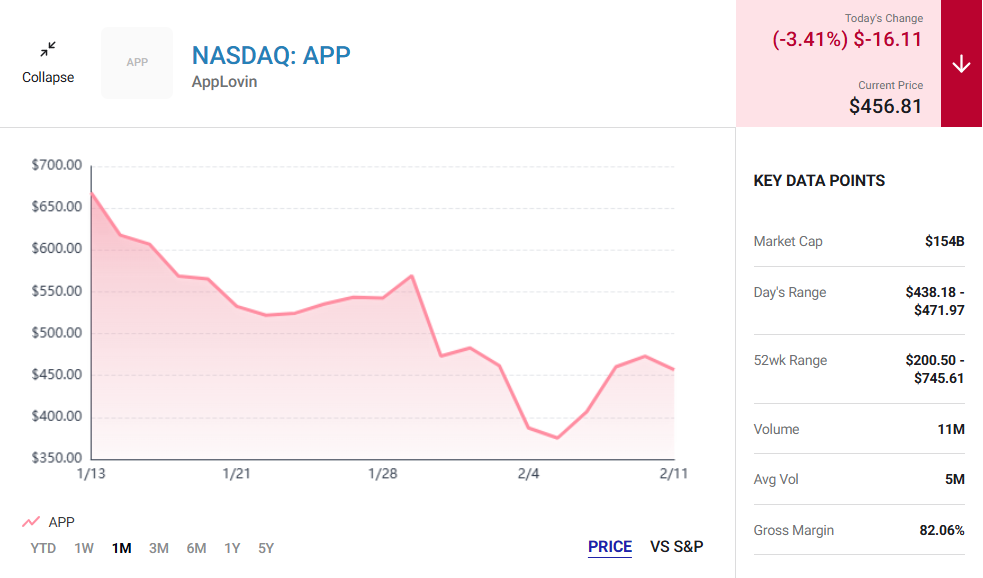

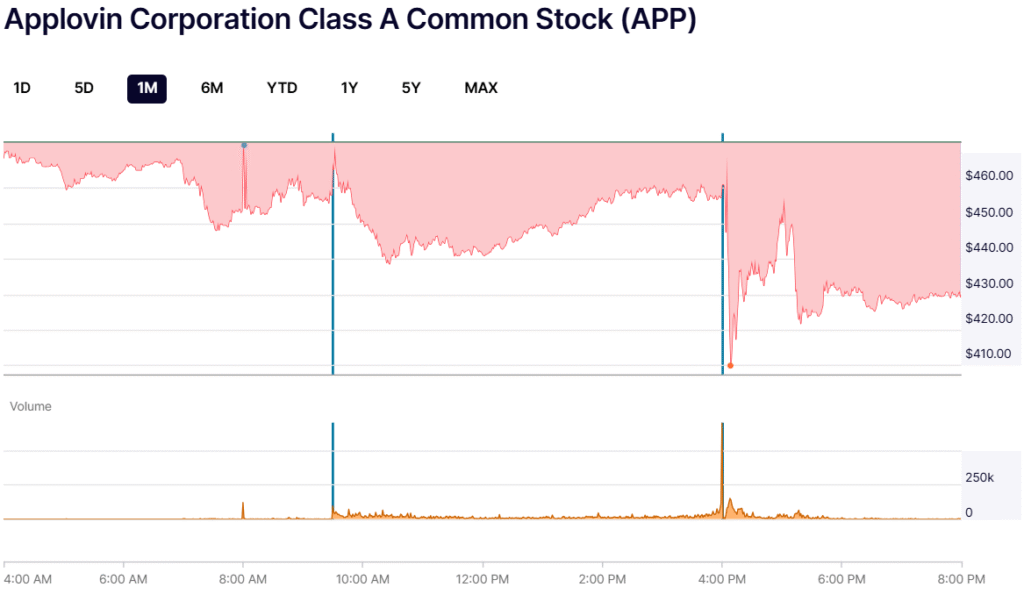

Despite the company’s solid financial performance, the after-hours trading action tells a different story. AppLovin’s stock was down 7.5% after the release of its Q4 report, continuing a 3.4% decline during the regular market session. Investors were clearly disappointed despite the better-than-expected results.

AppLovin’s Q1 2026 Guidance: Concerns Over Valuation

Looking forward to the first quarter of 2026, AppLovin issued revenue guidance of $1.745 billion to $1.775 billion. At the midpoint, this would represent year-over-year sales growth of 18.6%.

For adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), the company is projecting a range of $1.465 billion to $1.495 billion. If the midpoint is achieved, it would reflect a 47.3% increase in adjusted EBITDA.

While this guidance is strong, it doesn’t seem to be enough to support AppLovin’s current stock valuation. Investors appear to have been anticipating even more robust growth, and the stock’s decline suggests that the expectations were too high.

AppLovin’s stock had been on a positive run leading up to the earnings report, rising nearly 12% over the past five days. However, with the Q4 report now behind us and the Q1 2026 forecast not meeting market expectations, the stock seems to have gotten ahead of itself.

The Issue with AppLovin’s Stock Valuation

One of the key drivers of the sell-off is AppLovin’s stock valuation, which many investors consider rich given its current growth prospects. AppLovin is trading at a premium, with its stock priced at 45.9 times operating cash flow. This is a steep increase from its five-year average of 19.7 times operating cash flow.

The high valuation has likely prompted some investors to reevaluate the stock. While AppLovin has delivered impressive results in Q4, its forward guidance for Q1 2026 doesn’t seem to justify its elevated stock price. The combination of high expectations and a stock that has surged ahead of the market reality has led to a correction in the stock price.

Risks of Overvaluation in the Adtech Sector

- AppLovin operates in the growing adtech sector, benefiting from increased demand in mobile advertising and AI-powered solutions.

- Despite the industry’s growth, AppLovin’s stock valuation is seen as unsustainable, especially when compared to its competitors.

- For investors seeking adtech exposure, alternative investments may offer a more attractive entry point.

- AppLovin’s current high valuation has already resulted in substantial growth, leaving limited room for further upside without significantly exceeding forecasted figures.

Long-Term Outlook and Investor Sentiment

Looking ahead, the adtech market remains promising, especially with the continued rise of mobile advertising and AI-powered tools. However, investors need to carefully assess the valuation and growth expectations surrounding companies like AppLovin. The company’s Q4 performance was strong, but its high stock price could make it susceptible to further corrections unless it delivers more compelling results in the upcoming quarters.

For investors with a long-term outlook, it’s important to carefully weigh the risks and rewards of investing in AppLovin. The company’s ability to maintain strong growth in the face of high expectations will be crucial to its future performance.

Final Thoughts

AppLovin’s post-earnings sell-off serves as a reminder of the impact that overvaluation and unmet expectations can have on stock prices, even when a company beats earnings estimates. As many financial experts suggest, while the adtech sector holds significant potential, it’s crucial for investors to carefully evaluate stock valuations and future growth prospects before making investment decisions.

AppLovin’s performance in the coming quarters will determine whether its stock can recover or if it will remain under pressure. Investors should stay alert to market trends and adjust their portfolios accordingly as the adtech space continues to evolve.