Markets opened cautiously this morning as traders prepared for the November Consumer Price Index release at 8:30 AM Eastern Time. A senior financial analyst at Logirium examines why this particular inflation report carries more uncertainty than usual and what investors should focus on beyond the headline numbers.

The Bureau of Labor Statistics will publish November inflation data without the usual October baseline. The government shutdown that stretched through October prevented critical data collection. This creates a statistical gap that makes standard month-over-month comparisons impossible for many categories.

The Data Gap Problem

Wall Street typically relies on monthly inflation changes to gauge momentum. Those figures drive Federal Reserve policy expectations and influence everything from bond yields to equity valuations. Without the October data, the November CPI loses its most important comparative measure.

Year-over-year figures will still appear in today’s release. Market consensus places headline inflation between 2.9% and 3.1%. That represents a potential uptick from September’s 3.0% reading. Core inflation, which strips out volatile food and energy prices, faces similar expectations at roughly 3.1% annually.

The Bureau confirmed that categories relying on October survey data won’t show November monthly changes. Housing components, which make up roughly one-third of the CPI basket, fall into this category. Medical care services and certain transportation costs face the same limitation.

Strategic Market Implications

The incomplete data arrives at a particularly sensitive moment. The Federal Reserve has cut interest rates three times in 2025. Those reductions came as policymakers balanced still-elevated inflation against signs of labor market cooling. The central bank now faces a challenging decision matrix with less information than normal.

Bond markets have already priced in expectations. Swaps currently imply only 20% odds of a January rate cut, with a full reduction not anticipated until mid-2026. Those probabilities could shift dramatically based on how markets interpret today’s flawed data set.

Major investment banks have split on interpretation strategies. Some analysts argue that comparing November index levels against September provides a rough two-month average. Others warn that this method introduces its own distortions and recommend waiting for cleaner December data.

The Tariff Variable

Trade policy adds another layer of complexity. Recent tariff implementations have pushed goods prices higher throughout the second half of 2025. Automobiles and apparel saw notable increases in earlier reports. Those categories don’t dominate the overall index, but their directional impact matters for inflation psychology.

Economists at major institutions predict tariff effects have peaked in recent months and should moderate going forward. However, that thesis remains untested given the October data gap. A stronger-than-expected November reading could challenge assumptions about tariff impact timing.

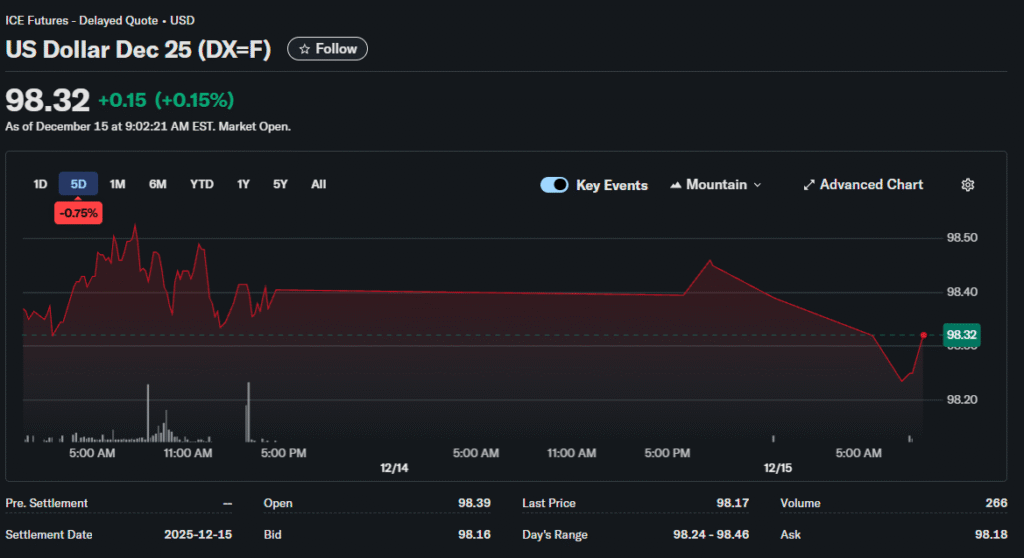

The dollar has traded near multi-month lows as rate cut expectations evolved. Currency markets will parse today’s release for clues about Federal Reserve flexibility. Any surprise in either direction could trigger swift repositioning in foreign exchange pairs.

What Professional Traders Watch

Sophisticated market participants understand that headline figures tell only part of the story during irregular data releases. Service inflation deserves particular attention. That component has shown more persistence than goods prices throughout 2025’s disinflation process.

Shelter costs represent the single largest CPI category. The methodology for measuring housing inflation lags actual market conditions by several months. This structural feature means today’s shelter data reflects rental market conditions from earlier in the year when dynamics differed from current trends.

Health insurance calculations present another technical consideration. The BLS recently incorporated new health insurance information that some analysts expect to drag both headline and core readings lower. This adjustment affects CPI but not PCE inflation, creating potential divergence between the two key measures.

Investment Portfolio Positioning

Fixed income traders have already begun adjusting duration exposure ahead of the release. Treasury yields edged mildly lower in recent sessions as uncertainty built around the report. A benign inflation print could accelerate the dovish repricing that stalled in recent weeks.

Equity markets face crosscurrents. Technology stocks showed unexpected strength in Tuesday’s session after weeks of sector rotation. The sustainability of that move likely depends on whether today’s data supports continued Fed flexibility or suggests policy tightening remains necessary.

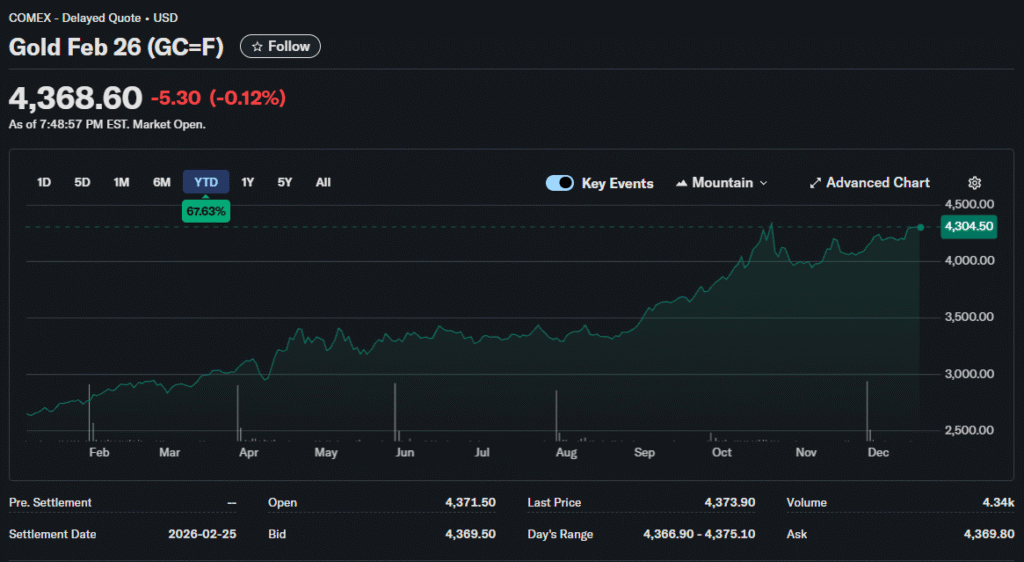

Gold prices have benefited from dollar weakness and rate cut expectations. The precious metal sits near recent highs as traders hedge against potential inflation surprises. A hotter-than-expected report could paradoxically boost gold through real rate calculations.

The December Outlook

Market participants already look past today’s compromised data toward the December CPI release scheduled for January. That report should provide cleaner month-over-month figures and help validate or refute trends suggested by November’s incomplete numbers.

The clustering of employment and inflation data in this mid-December window creates additional volatility potential. Delayed November payroll figures released Monday showed mixed signals about labor market health. Today’s inflation data completes the picture that guides year-end positioning.

Professional investors should treat today’s release as one data point in a longer series rather than a definitive inflation signal. The statistical irregularities demand more cautious interpretation than typical CPI reports. Markets that overreact to incomplete information often face reversals once clearer data emerges.