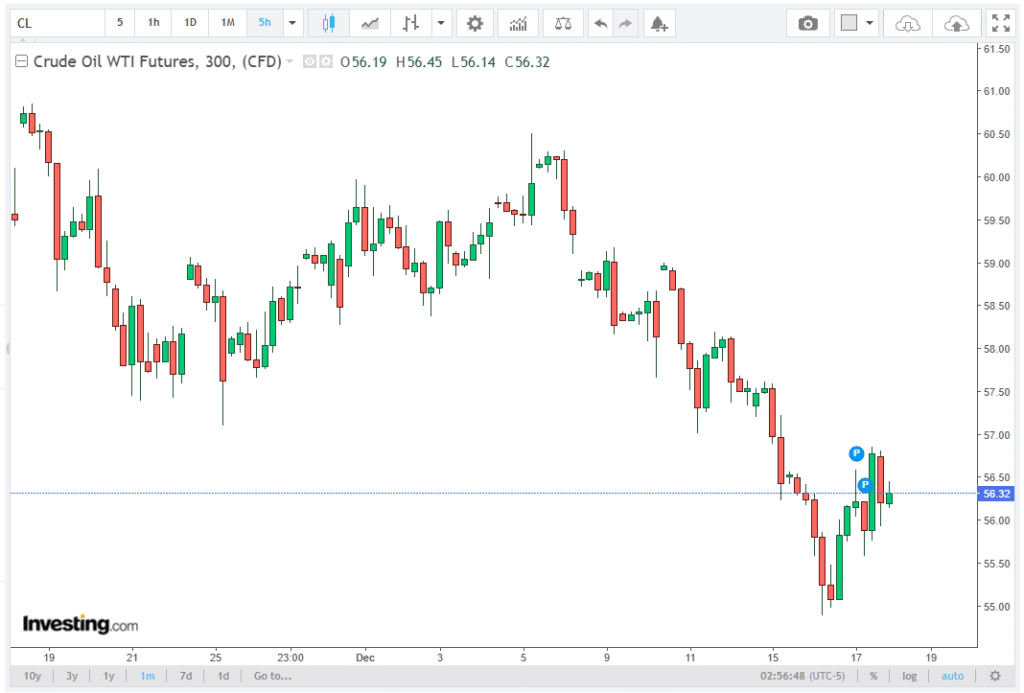

West Texas Intermediate (WTI), the US crude oil benchmark, edged lower to around $56.30 in early European trading on Thursday. The decline in WTI prices comes amid renewed strength in the US Dollar (USD) and signs of softening energy demand from China, the world’s largest crude importer. Servelius brokers outline the essential details of the subject with precision and insight.

WTI Price Declines on USD Rebound

During the early European session, WTI crude traded near $56.30, down from previous levels above $56.50. The downward move in oil prices is primarily influenced by a resurgent US Dollar, which increases the cost of USD-denominated commodities for foreign buyers.

The Greenback gained traction following cautious commentary from several Federal Reserve (Fed) officials this week. Fed Governor Christopher Waller on Wednesday indicated that while further interest-rate cuts could help bring the central bank’s stance back to neutral, there is no need to rush due to persistent inflationary pressures, according to Bloomberg.

Additionally, Atlanta Fed President Raphael Bostic suggested that last week’s decision to reduce rates may not have been justified and projected no further rate cuts in the coming year. These mixed signals from the Fed contributed to a modest USD rebound, putting pressure on WTI prices as the commodity becomes more expensive in other currencies.

Impact of USD Strength on Global Oil Markets

The strengthening US Dollar continues to influence global oil markets, including WTI crude. As oil is priced in USD, a stronger Greenback makes crude imports more expensive for countries using other currencies, potentially reducing demand.

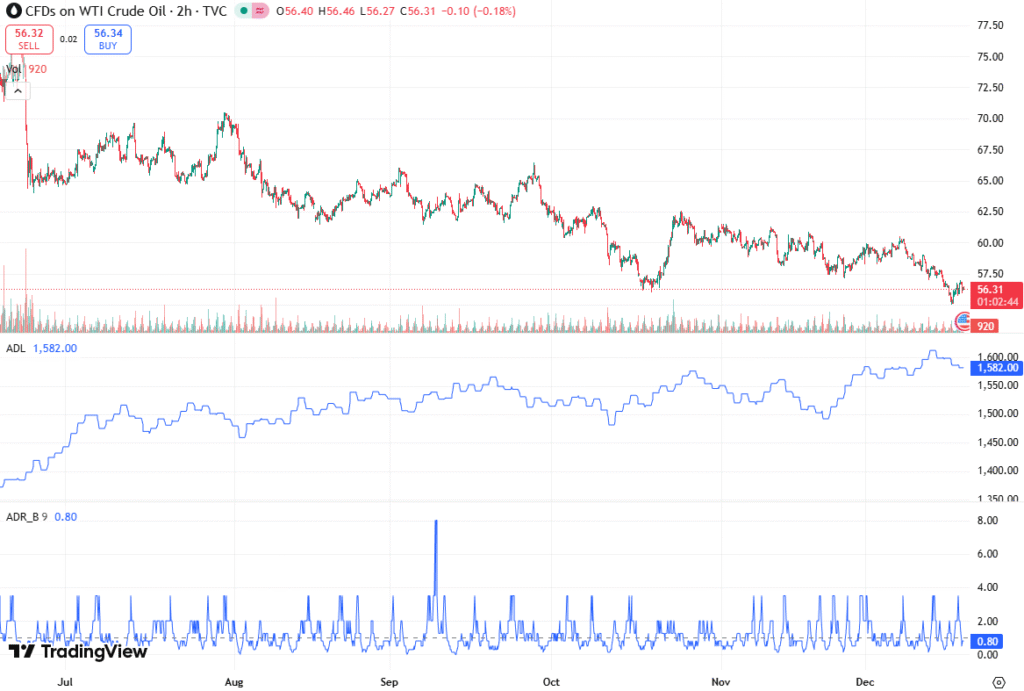

Investors and traders often react to USD fluctuations by adjusting oil positions, leading to short-term price volatility. Analysts note that if the USD maintains momentum, WTI could face sustained downward pressure, unless offset by supply disruptions or geopolitical tensions.

Chinese Demand Weakness and Global Energy Outlook

China’s slower economic growth and soft energy demand remain key factors for WTI price dynamics. The weaker Retail Sales and Industrial Production data indicate that Chinese crude imports may soften, affecting global oil consumption forecasts.

For energy traders, these signals suggest potential bearish sentiment in the near term, particularly if economic indicators continue to underperform expectations. WTI crude may face additional headwinds if China’s demand recovery remains sluggish, highlighting the importance of monitoring Asian energy trends for market positioning.

Weak Chinese Economic Data Sparks Demand Concerns

Another major factor weighing on WTI is sluggish demand from China. Recent economic indicators point to slower growth than expected, stoking fears of weaker global energy demand.

According to the National Bureau of Statistics (NBS), China’s Retail Sales rose only 1.3% year-on-year (YoY) in November, down from 2.9% in October and below the market forecast of 2.9%. Similarly, Industrial Production climbed 4.8% YoY, missing expectations of 5.0%.

These soft economic data suggest that Chinese crude imports could weaken, reducing global oil demand. Given that China accounts for a significant portion of world crude consumption, the market sentiment around WTI remains bearish in the near term.

Geopolitical Tensions May Support Prices

While WTI faces pressure from USD strength and soft Chinese demand, geopolitical developments could limit further declines. The US President recently announced that the US would block sanctioned tankers from entering or leaving Venezuela, threatening the country’s oil exports.

In response, the Venezuelan government ordered its navy to escort vessels carrying petroleum products from ports, according to the New York Times. This move is a direct challenge to the US President’s blockade threat, raising the risk of potential confrontation and supply disruptions.

Such geopolitical risks often act as a floor for oil prices, preventing WTI from falling sharply even amid weaker demand signals. Analysts note that supply-side uncertainties like these can create volatility in crude markets, especially for USD-denominated commodities.

Market Outlook for WTI

The near-term outlook for WTI crude appears cautiously bearish, driven by the combination of USD strength and soft Chinese economic indicators. Technical indicators suggest that WTI support may hold around $56.00, while immediate resistance is seen near $57.00–$57.20.

The US Dollar Index (DXY) could remain a key factor, as further USD gains may continue to weigh on oil prices. Chinese demand trends will also be closely watched, particularly with upcoming industrial and retail data.

Conclusion

WTI crude oil is trading near $56.30, pressured by a strengthening US Dollar and slower-than-expected Chinese demand. Fed commentary has contributed to the USD rebound, while soft Chinese Retail Sales and Industrial Production figures point to potential weaker global oil demand.

On the supply side, Venezuelan naval escorts against US blockade threats introduce geopolitical risk, which could support prices despite demand concerns.

In this mixed environment, WTI traders must balance macro signals, including US monetary policy, Chinese economic data, and geopolitical developments, to navigate the volatile crude market.