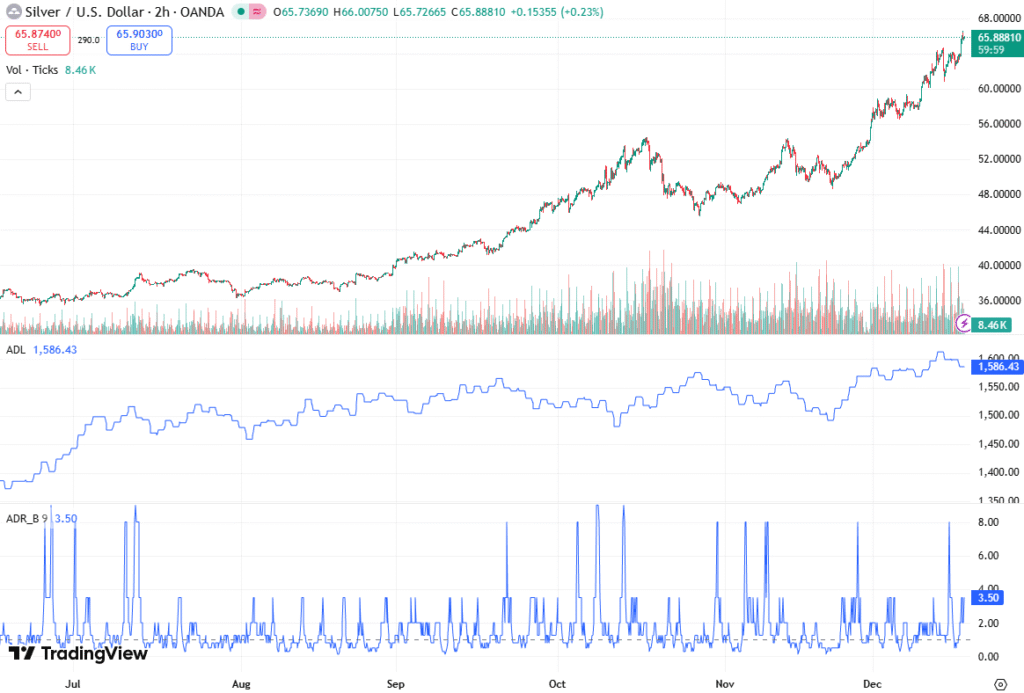

Silver (XAG/USD) remains resilient above the $65.50 level during Wednesday’s European session, after reaching record highs at $66.54 earlier today. The precious metal’s recent surge is being fueled by weak US labour data and renewed expectations of Federal Reserve monetary easing, creating a bullish environment for traders seeking safe-haven assets.

This article by Tarillium offers expert commentary and a complete explanation of the subject.

Market Drivers: Weak Labour Data and Fed Easing Expectations

The US Nonfarm Payroll report released on Tuesday painted a mixed picture of the labor market. Net employment fell by 105,000 in October, while November posted a smaller-than-expected recovery with a 64,000 increase. Despite this rebound, the unemployment rate climbed to 4.6%, a four-year high, while wage growth moderated further.

This disappointing labour data has reignited speculation that the Federal Reserve may pivot towards monetary easing sooner rather than later. Futures markets are pricing in a 42% probability of a March rate cut, keeping precious metals, including silver, supported. Investors are now awaiting November’s US Consumer Prices Index (CPI), due this Friday, which could provide further clarity on the Fed’s policy trajectory.

Technical Analysis: Bullish Momentum Remains Intact

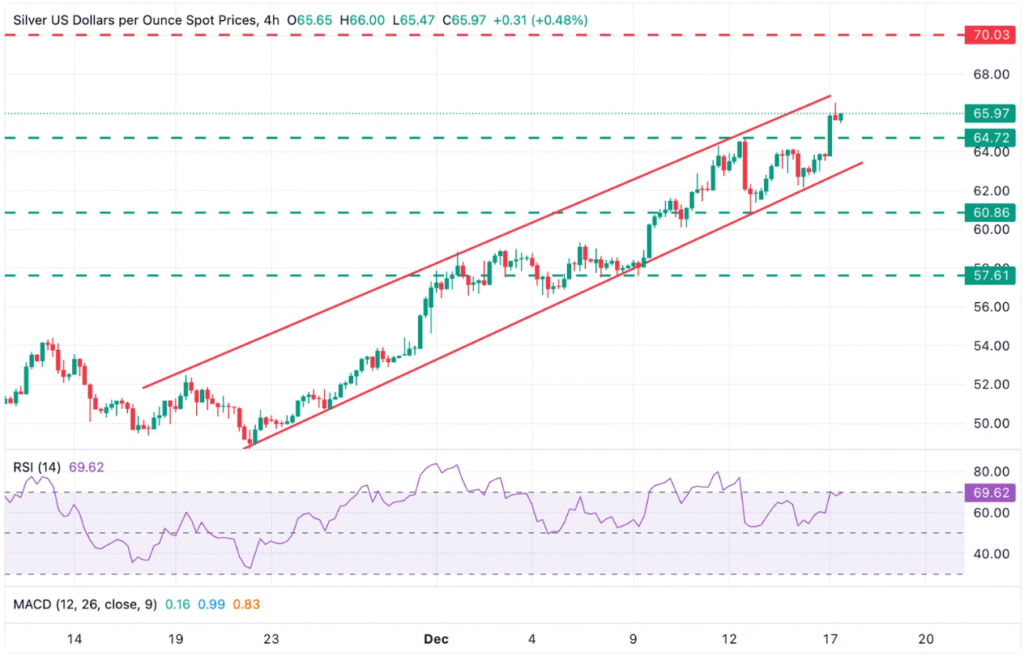

The XAG/USD pair is trading at $65.97, almost 3.5% higher than the day’s opening price, indicating strong bullish momentum. A closer look at the 4-hour chart reveals a well-defined ascending trend line originating from $48.57 lows in mid-November. This trend line currently provides robust support near $63.12, reinforcing the bullish bias.

The Moving Average Convergence Divergence (MACD) has turned positive, with a widening histogram, signaling strengthening upside momentum. Meanwhile, the Relative Strength Index (RSI) stands at 69.62, approaching overbought territory, suggesting that while momentum remains strong, upside may slow near resistance levels.

The next technical hurdle is the top of the ascending channel, around $66.80, where XAG/USD bulls may encounter significant resistance. Should the pair breach this level, the 261.8% Fibonacci extension of the October-November rally at $68.30 becomes a potential target, followed by the psychologically important $70.00 level.

Support Levels: Key Areas to Watch

On the downside, XAG/USD finds immediate support at its previous all-time high, near $64.72, which may act as a floor if profit-taking occurs. A further drop could see trendline support around $63.30, aligning with the mid-term ascending channel. The December 12 low, near $60.80, represents a critical support level for traders seeking risk management thresholds.

These levels are particularly important for swing traders and technical analysts, as they offer a clear roadmap for entry and exit points in the current market environment.

Silver Outlook: Fed Policy and Macro Trends

The near-term bullish outlook for silver is closely tied to US macroeconomic data and monetary policy expectations. With labour market weakness and a slower wage growth trajectory, the case for Fed easing continues to underpin precious metals.

Should the CPI data on Friday confirm moderating inflation, the probability of a rate cut may rise, potentially sending XAG/USD toward its $68–$70 range. Conversely, strong inflation readings could dampen silver gains, testing support at $64.72 and lower trendline levels.

Additionally, geopolitical tensions, US dollar fluctuations, and broader risk sentiment remain crucial macro factors influencing silver price dynamics.

Trading Considerations

The upside targets for the asset are significant, with $66.80 representing the trendline resistance, followed by $68.30, which aligns with the 261.8% Fibonacci extension, and finally the $70.00 psychological level, a key round-number barrier where market sentiment may shift.

On the downside, critical support levels include $64.72, the previous high, $63.30, which corresponds to the trendline, and $60.80, the December 12 low, acting as a strong historical floor.

From a technical indicators perspective, the MACD is positive, suggesting ongoing bullish momentum, while the RSI sits at 69.62, approaching overbought territory, indicating caution is warranted. Market drivers currently influencing price action include weak US labour data, Fed easing expectations, and the upcoming CPI release, all of which can significantly impact volatility.

Traders should remain vigilant for reversal signals near $66.80, where profit-taking could slow the bullish momentum, while also keeping a close watch on macroeconomic releases and USD movements to ensure effective risk management in the evolving market environment.

Conclusion

Silver (XAG/USD) continues to demonstrate resilience, holding gains in the $65.50–$66.50 range as market participants digest labour market weakness and Fed policy expectations. Technical indicators support the bullish bias, though resistance at $66.80 may cap near-term upside.

In summary, silver remains well-positioned for potential further gains, supported by monetary easing hopes, strong technical momentum, and macro uncertainty, making it a focus asset for both traders and investors in the weeks ahead.